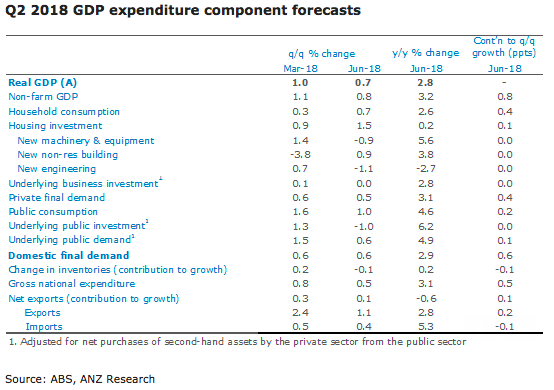

Australia’s gross domestic product (GDP) for the second quarter of this year is expected to have risen a solid 0.7 percent q/q, following a rise of 1.0 percent in Q1. This would see annual growth edge down to 2.8 percent, although annualised H1 growth would be a strong 3.5 percent, according to the latest report from ANZ Research.

In tomorrow’s report, the focus is likely once again to be on the household indicators – consumption and wages. Strong growth in retail sales volumes (1.2 percent) suggest a solid outcome for Q2 consumer spending although keep in mind that retail spending accounts for only around 30 percent of consumption.

Weakness in car sales and some services is likely to provide some offset to the retail strength. On wages, the GDP measure of average wages will be closely watched. Preliminary data suggest that this is likely to show ongoing modest acceleration, consistent with the broad sweep of wages indicators.

"The investment numbers will also be closely watched given their importance in the current upswing. While the capex survey suggested mining investment fell sharply, we expect to see another solid rise in non-mining investment," the report commented.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed