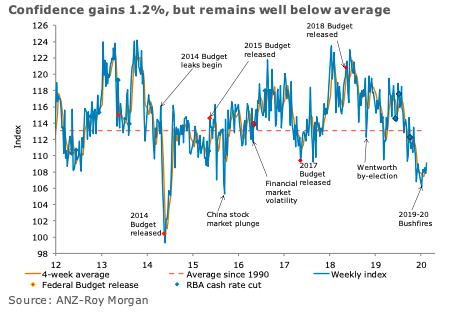

Australia’s ANZ-Roy Morgan consumer confidence gained 1.2 percent last week, more than reversing last week’s loss and continuing the recent sawtooth pattern. The gains have been a little more than the losses, so the index reached its 2020 high last week.

‘Current finances’ gained 2 percent last week, while ‘future finances’ were marginally down by 0.1 percent. ‘Current economic conditions’ registered a healthy gain of 6.5 percent compared to a fall of 4.1 percent seen last week, while ‘future economic conditions’ were flat.

‘Time to buy a major household item’ fell 0.9 percent, adding to the loss of 5 percent seen in the previous reading. The four-week moving average for ‘inflation expectations’ fell by 0.1ppt to 4.0 percent, while the weekly reading remained stable.

"The ANZ Roy-Morgan Australian Consumer Confidence index has risen to its highest level in 2020, with sentiment possibly buoyed by the continued gains in asset prices. The fact the coronavirus hasn’t become established in Australia might be a contributing factor, although the measures taken by the Government to help ensure this remains the case will have economic consequences. This week the key domestic influences on sentiment will be wage and employment data. We aren’t expecting the news to be flash, which may see confidence dip over the coming week and so continue the up and down behaviour seen in recent weeks," said David Plank, ANZ’s Head of Australian Economics.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains