Adidas shares plunged by 12.6% late last week after issuing a warning that this could result in a big loss this year which would be the first time for the company in three decades. The company said that this event was triggered by its break-up with Kanye West.

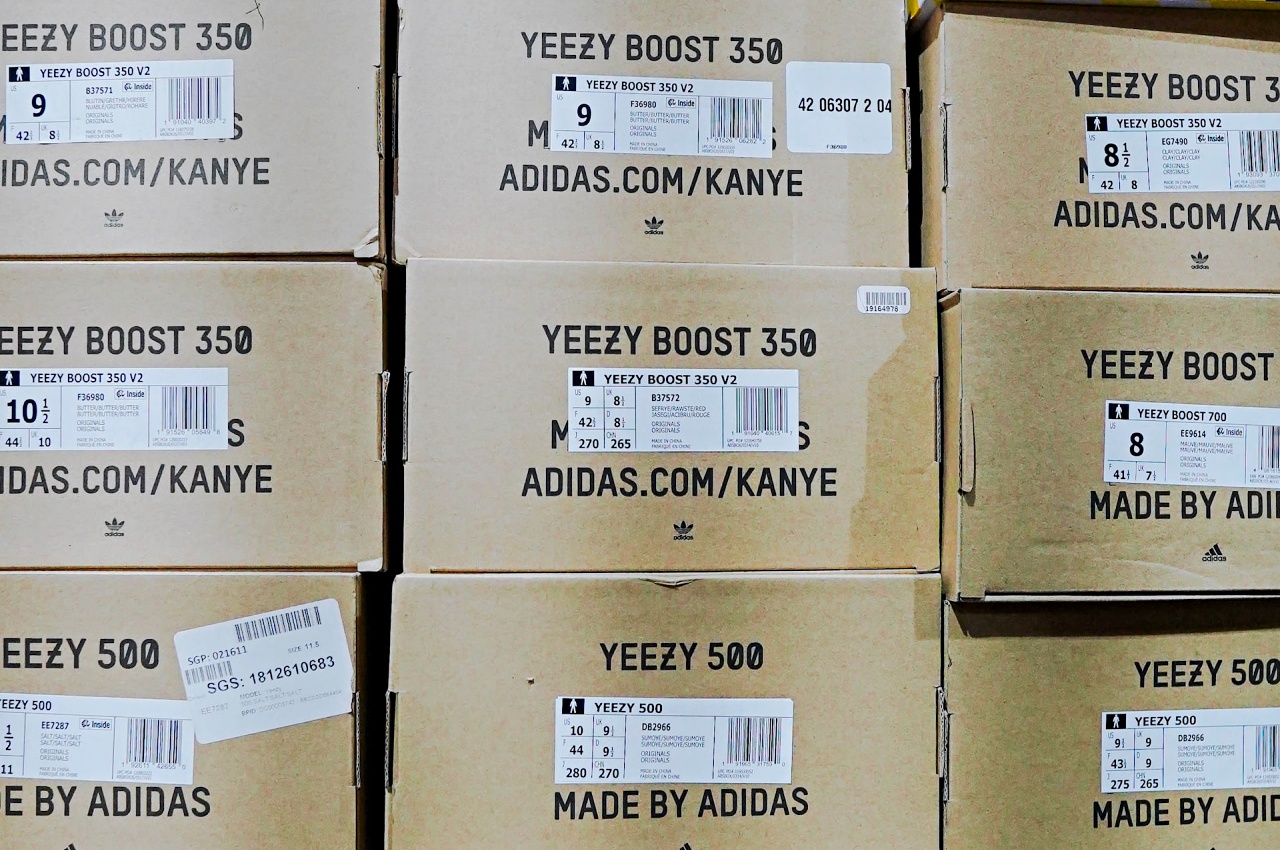

According to Reuters, Adidas said that its inventory of West’s Yeezy brand could be completely crossed out and could lead to a $749 million loss this year. This is because the sneakers and sportswear under the brand have price tags of up to $700.

The German sportswear and sneaker maker further said that by not selling the stocks of Yeezy items alone, it would take a hit of €1.2 billion or a $1.3 billion revenue loss this year. Its operating profit will also plummet by around €500 million to break even.

"The numbers speak for themselves,” Adidas’ new chief executive officer, Bjorn Gulden, said in a statement. “We are currently not performing the way we should."

Adidas severed its ties with Kanye West following his antisemitic comments on social media. He was also involved in various controversies and with all the negative issues, the company made the decision to split up with the rapper.

Shortly after the split with West, the company said it will sell Yeezy’s clothing pieces and shoes under a new name. It will be rebranded but selling them under its own branding will save Adidas some $300 million in royalty payments and marketing fees. However, some business analysts said that this repurposing scheme will create problems.

“There really are no good options for this distressed brand that sat somewhere between prestige and luxury,” CNN Business quoted Strategic Resource Group’s retail expert and managing director, Burt Flickinger, as saying in a statement.

Finally, it was reported that at this time, Adidas is still trying to figure out what to do with all of its Yeezy inventory. If it fails to find a way to sell the products, it could suffer significant losses. Then again, the sneaker maker is already expecting a decline in its sales this year, at a high single-digit rate.

Photo by: Alex Haney/Unsplash

Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns

Panama Supreme Court Voids CK Hutchison Port Concessions, Raising Geopolitical and Trade Concerns  Apple Earnings Beat Expectations as iPhone Sales Surge to Four-Year High

Apple Earnings Beat Expectations as iPhone Sales Surge to Four-Year High  Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.

Canada’s Trade Deficit Jumps in November as Exports Slide and Firms Diversify Away From U.S.  Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty

Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Sandisk Stock Soars After Blowout Earnings and AI-Driven Outlook

Sandisk Stock Soars After Blowout Earnings and AI-Driven Outlook  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  IMF Forecasts Global Inflation Decline as Growth Remains Resilient

IMF Forecasts Global Inflation Decline as Growth Remains Resilient  China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy

China Manufacturing PMI Slips Into Contraction in January as Weak Demand Pressures Economy  OpenAI Reportedly Eyes Late-2026 IPO Amid Rising Competition and Massive Funding Needs

OpenAI Reportedly Eyes Late-2026 IPO Amid Rising Competition and Massive Funding Needs  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  Federal Judge Signals Possible Dismissal of xAI Lawsuit Against OpenAI

Federal Judge Signals Possible Dismissal of xAI Lawsuit Against OpenAI  Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions  Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry

Starmer’s China Visit Highlights Western Balancing Act Amid U.S.-China Rivalry  UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist

UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas

U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas