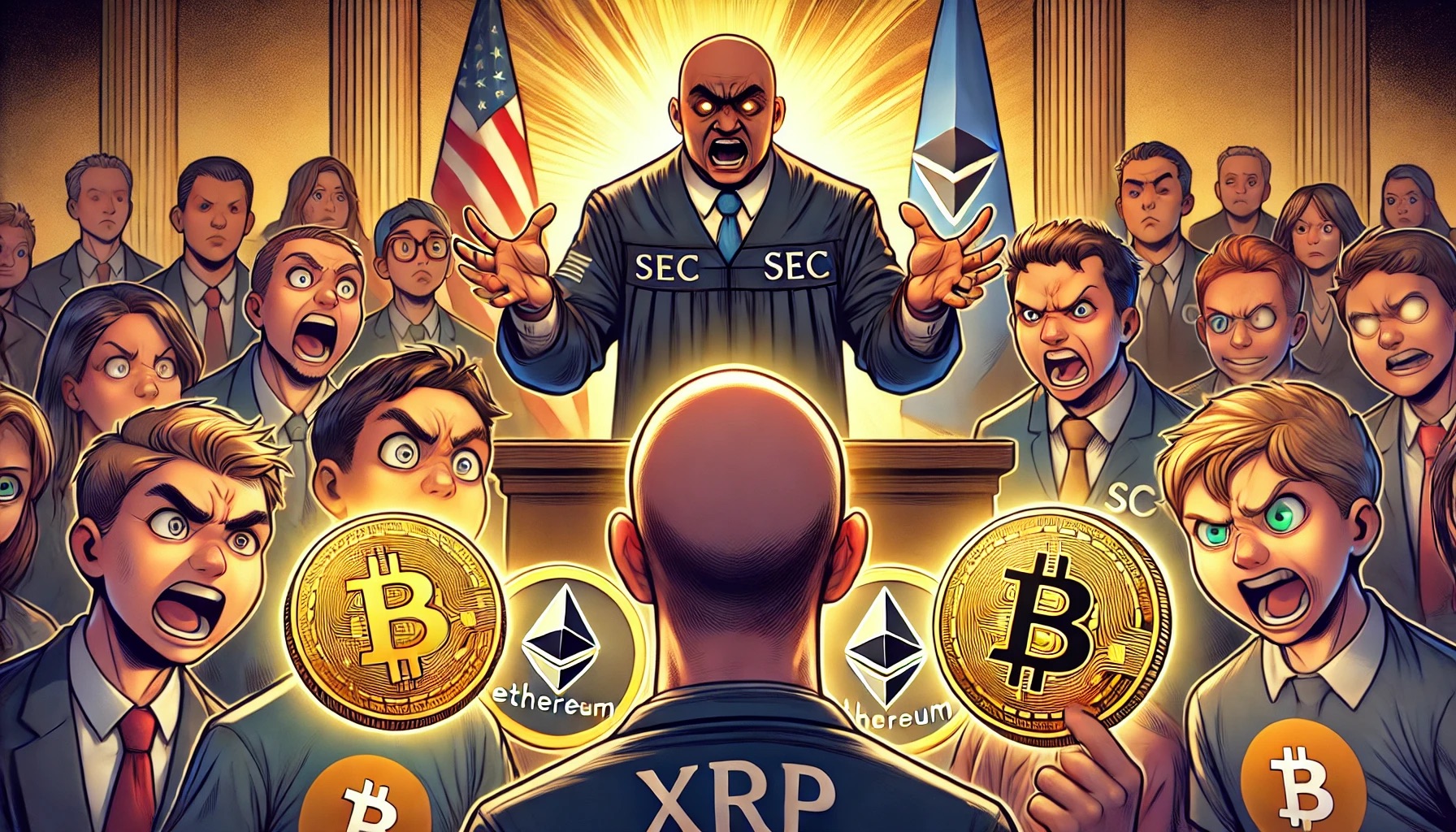

The XRP community is furious over allegations that the US SEC is favoring Bitcoin and Ethereum, a move seen as deeply unfair by XRP supporters and sparking widespread criticism in the crypto world.

XRP Community Fumes Over Alleged SEC Favoritism

Many in the XRP community feel the US SEC is trying to influence the cryptocurrency market through manipulation. Crypto aficionados have recently taken to social media in droves, accusing the agency of having a bias towards Bitcoin and Ethereum.

Coingape reveals that a surge of social media investors brought attention to the remarks made by William Hinman, the former director of the agency, about Ethereum. This has only served to heighten the already heated debate around the cryptocurrency market.

XRP Supporters Criticize SEC’s Alleged Bias

The XRP community has reignited the X conversation by casting doubt on the US SEC's impartiality towards Ethereum and Bitcoin. X user "Digital Asset Investor" recently posted a video on X that included Nancy Wojtas, who was a former lawyer for the SEC. Throughout the video, her focus was on:

The community sees the remark as evidence of the SEC's hypocrisy, which they say allowed Ethereum to prosper while it scrutinized Ripple's native coin and other digital assets. The user went on to say that the government body knowingly left regulatory loopholes open so that cryptocurrencies like Bitcoin and Ethereum might have an advantage.

They wanted to know why Vitalik Buterin, creator of Ether and a recent admittance that he sold ETH to fund other companies, had not been subject to the same legal action as Ripple. While discussing his recent ETH sales, Buterin made the following statement:

His actions were criticized by the XRP community, who compared them to a securities transaction and wondered why the agency hadn't done the same for Ethereum.

Frustration Grows Over Ripple’s Legal Battle Outcome

The community was understandably frustrated because the four-year legal struggle between Ripple and the US SEC finally came to a close without any claims of fraud. Some say the agency's lenient stance towards Ethereum is in stark contrast to its harsh stance towards Ripple.

Digital Asset Investor also raised concerns about the agency's decision to end its inquiry into the security status of Ethereum, citing a comment made by former director Hinman in 2018 in which he denied that Ethereum constituted a security. There has been much debate regarding this choice and its ties to the cryptocurrency market for some time.

Pro-XRP Lawyer Points Out SEC’s Partiality

Elon Musk's remarks about monopolistic behavior by industry authorities were recently quoted by pro-XRP lawyer Bill Morgan, who shared this sentiment. Morgan claimed that there was obvious partiality in the agency's behavior under Hinman's and former Chair Jay Clayton's tenure.

However, worries among the XRP community have grown stronger this year, particularly following the agency's decision to withdraw its lawsuit contesting Ethereum's security certification. Additionally, it occurs shortly before the first Spot Ethereum ETF in the US is approved.

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO