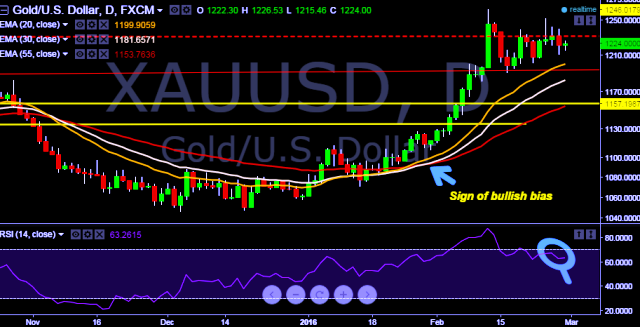

- Pair is currently trading at $1223 levels.

- It made intraday high at $1226 levels and low at $1215 levels.

- Intraday bias remains neutral till the time pair holds key resistance at $1228 levels.

- A daily close above $1232 is required to confirm the bullish bias.

- On the top side key resistance falls at $1242 marks.

- Alternatively, reversal from $1226 will drag the parity below $1218 levels.

- Key resistance levels are seen at $1228, $1232 and $1242 thereafter.

- Key support levels are falls at $1222, $1217 and $1212 levels.

We prefer to take long position in XAU/USD around $1220, stop loss $1210 and target $1232/$1242 thereafter.