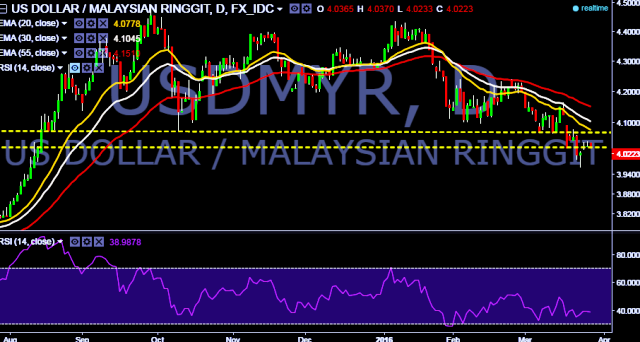

- Pair is currently trading around 4.0223.

- It made intraday high at 4.0370 and low at 4.0233 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 4.0370.

- A sustained break above key resistance will drag the parity towards 4.0640/4.0933 marks.

- Alternatively, reversal from key resistance will drag the parity down around 4.0086 (August 2015 low)/ 3.9916/ 3.9553 levels.

We prefer to take short position in USD/MYR around 4.0275, stop loss 4.0370 and target 4.0086/3.9916 marks.