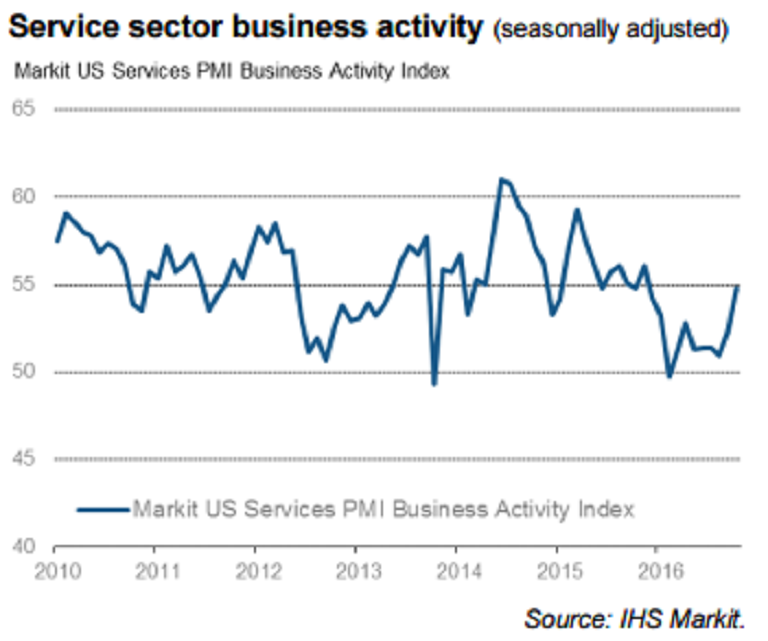

Service sector growth in the United States rose to 1-year high during the month of October, cementing prospects of a December interest rate hike by the Federal Reserve. Survey respondents attributed the recovery in growth momentum to improving domestic economic conditions and greater consumer spending in particular.

Adjusted for seasonal influences, the final Markit U.S. Services Business Activity Index registered 54.8 in October, up markedly from 52.3 in September and above the crucial 50.0 no-change value for the eighth consecutive month. Also, the seasonally adjusted final Markit U.S. Composite PMI Output Index rose to 54.9 in October, from 52.3 in the previous month.

A robust and accelerated rise in incoming new work contributed to an accumulation of unfinished business at service sector companies in October. The rate of backlog accumulation was the fastest since March 2015 and slightly stronger than the post-crisis trend.

Both the manufacturing and service sector recorded faster rates of expansion in October. Production growth across the manufacturing sector was the fastest for 12 months (output index at 55.5). Meanwhile, service providers signalled a much sharper pace of input cost inflation than the 19- month low recorded in September.

"Indications of stronger economic growth, solid job creation, rising prices and improved business confidence all pave the way for the Fed to hike interest rates again by the end of the year," said Chris Williamson, Chief Business Economist, IHS Markit.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022