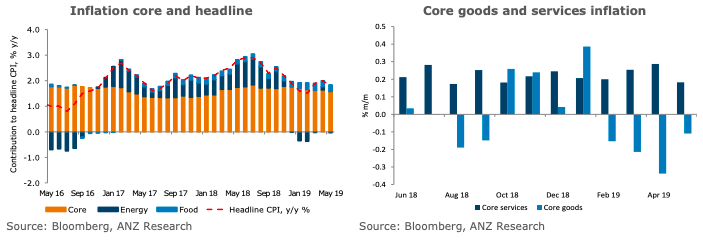

The United States’ core inflation is expected to rise by a 0.2 percent m/m in June after four consecutive months of just 0.1 percent. Underlying pricing pressures remain subdued. Domestic demand could use an extra bump to boost cyclical inflationary pressures, according to the latest report from ANZ Research.

The forecast pick-up in core inflation is predicated on an expected rebound in the prices of goods after contracting for four consecutive months. Both apparel and used vehicle prices should rise after a lengthy period of weakness.

That said, uncertainty surrounds the trajectory of apparel prices following Bureau of Labor Statistics’ (BLS) methodological change earlier this year. The BLS has expanded its sources of data to include outsourcing some of the data collection rather than relying only on its traditional in-house surveys.

Also likely contributing to higher goods prices in June should be the after effects of the US administration’s decision to raise the tariff rate on USD200bn of Chinese imports from 10% to 25% on 10 May.

This would add at most 0.1 ppt in total to the rate of inflation, according to analysis (Inflationary Effects of Trade Disputes with China) from the Federal Reserve Bank of San Francisco. Only a small part of this amount would likely occur in the month of June.

"We look to FOMC Chair Powell’s testimony and the June meeting minutes for guidance on the timing of easing. With the market pricing a 25bp cut in July as a done deal, Fed speakers need to push back if this is unwarranted. A further deterioration in global manufacturing and lackluster domestic inflation suggest that a cut is warranted soon," the report further commented.

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions