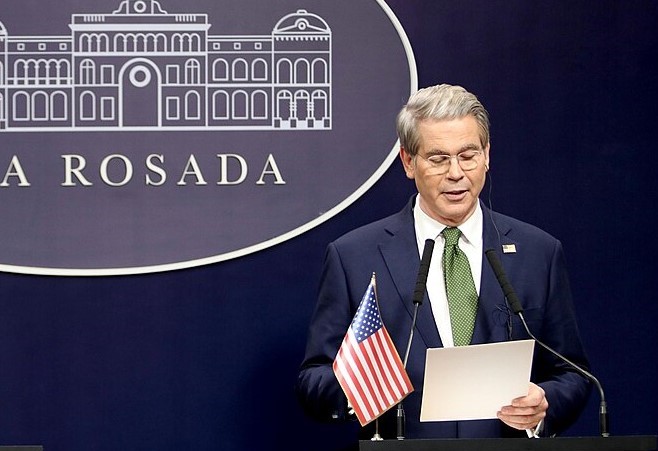

U.S. Treasury Secretary Scott Bessent announced Thursday that the Biden-era global tax framework will be modified under a new G7 agreement, prompting the removal of the controversial Section 899 tax proposal from the Republican tax and spending bill.

Section 899, introduced by GOP lawmakers, would have allowed President Donald Trump to impose retaliatory taxes on countries targeting U.S. firms under the 2021 OECD global tax deal. However, Bessent confirmed that the agreement with the Group of Seven nations shields American companies from the 15% global minimum tax under “Pillar 2” of the OECD-G20 Inclusive Framework.

“After months of productive dialogue, the U.S. and G7 have reached a joint understanding that protects American interests,” Bessent posted on X. He added that the countries would cooperate on implementing the new deal in the coming months.

This move potentially paves the way for Trump to fulfill his pledge to withdraw the U.S. from the OECD tax agreement while minimizing international fallout. The revised deal appears to address key concerns from U.S. corporations and Republicans, particularly around digital services taxes and global reallocation of taxing rights.

Bessent’s statement followed news that GOP lawmakers, facing internal opposition and pressure from the business community, were considering scrapping Section 899. The updated tax legislation is now expected to move forward, with final votes possibly taking place as early as Saturday, ahead of the July 4 holiday.

“This G7 consensus promotes economic stability and encourages investment in the U.S. and worldwide,” Bessent said.

The new deal marks a significant shift in U.S. tax policy, easing tensions with allies while aligning with Trump’s pro-growth, pro-business agenda as he pushes to finalize the tax bill swiftly.

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil

Trump Proposes Two-Year Shutdown of Kennedy Center Amid Ongoing Turmoil  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement

Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift

China Approves First Import Batch of Nvidia H200 AI Chips Amid Strategic Shift  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal