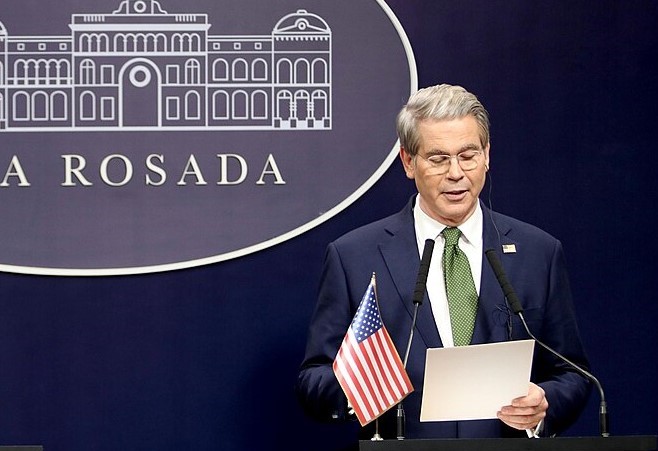

The United States has announced a $20 billion financial support package for Argentina, signaling strong backing for President Javier Milei’s economic reform agenda. U.S. Treasury Secretary Scott Bessent emphasized that the initiative is not a bailout but a strategic investment aimed at stabilizing Argentina’s struggling economy. He stated that the Argentine peso is currently undervalued and that the U.S. is actively purchasing pesos to support its exchange rate, affirming that the existing exchange rate band is appropriate.

Bessent underscored that stabilizing Argentina is a top priority for Washington, describing the move as part of a broader effort to strengthen regional stability and counter rising Chinese influence in Latin America. “We don’t want another failed or China-led state in Latin America,” he remarked, highlighting the geopolitical motivations behind the financial package.

In response, a spokesperson for the Chinese Embassy in Argentina criticized the U.S. approach, urging Washington to focus on genuine development efforts in Latin America and the Caribbean rather than hindering other nations’ cooperation. The spokesperson reiterated that the region is “not anyone’s backyard” and insisted that China’s partnerships with Latin American nations are based on mutual respect and shared growth.

Meanwhile, global trade tensions escalated after former President Donald Trump threatened to impose a “massive increase” in tariffs on Chinese imports. Trump’s warning followed Beijing’s new export controls on rare earth minerals—materials vital to the tech and defense industries. He also hinted that he might cancel his upcoming meeting with Chinese President Xi Jinping amid the rising dispute.

The developments underscore a growing U.S.-China rivalry extending beyond trade into global finance and geopolitical influence, with Argentina now emerging as a key focal point in this power struggle.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility