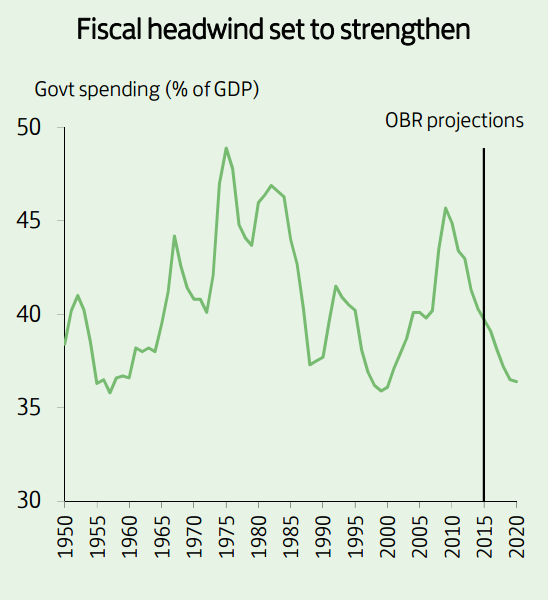

Ongoing fiscal austerity will continue to constrain overall economic growth. While the Chancellor's recent Autumn Statement modestly softened the near-term impact of the cut backs - increasing spending and cutting borrowing relative to the projections in the July Budget - the big picture remains that the bulk of the structural consolidation still lies ahead.

Indeed, the fiscal headwind over the next few years through to 2020-21 is set to be larger than that seen to date since 2010. Latest forecasts also project public spending as a share of GDP dropping to just 36.4% by 2020-21, a low previously only seen briefly in recent history in the late 1950s and late 1990s. The scale of the coming cuts continues to raise doubts about whether they will be achieved. Risks thus remain either of slippage, or of an outsized adverse impact on the economy.

UK fiscal headwind still strong

Thursday, December 10, 2015 10:01 PM UTC

Editor's Picks

- Market Data

Most Popular

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal