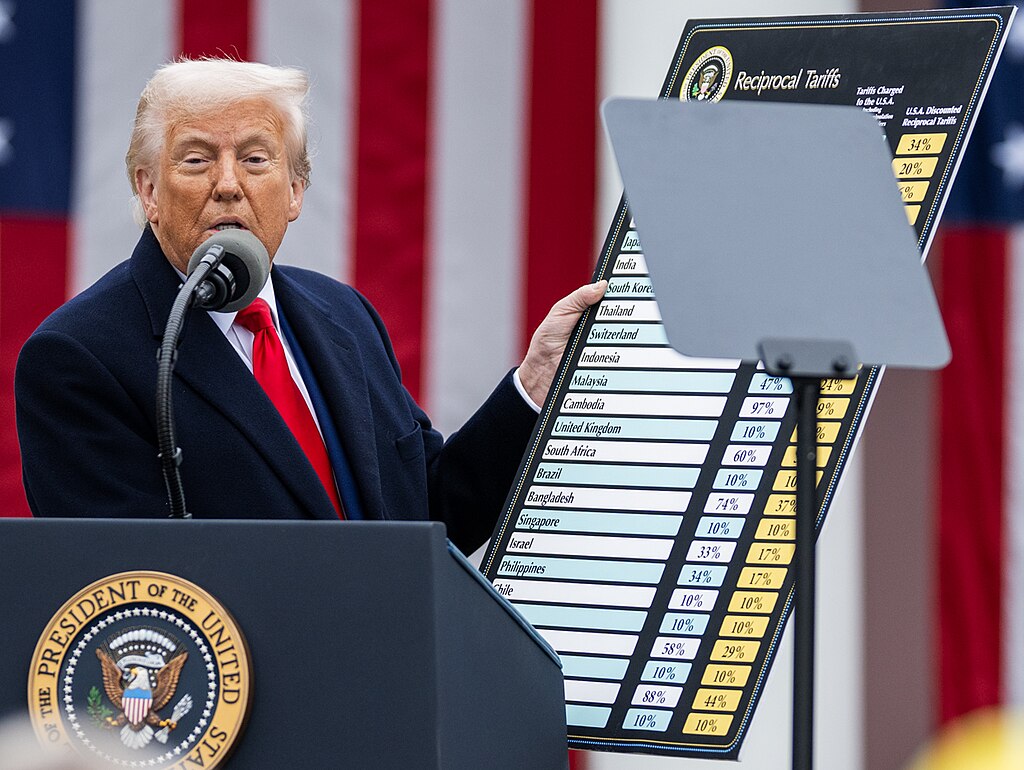

U.S. President Donald Trump said Wednesday that America’s trade deficit has narrowed significantly due to his 2025 trade tariffs, adding that the country could post its first trade surplus in decades as early as this year. In a social media statement, Trump claimed the U.S. trade deficit “has been reduced by 78% because of the tariffs being charged to other companies and countries,” though he did not clarify the specific timeframe behind the figure.

Recent government data shows the U.S. goods and services trade deficit dropped to $27.62 billion in October 2025, down from a record $140.5 billion in March 2025—an approximately 80% decline, based on Investing.com calculations. However, the deficit widened again to $56.82 billion in November, highlighting ongoing volatility in U.S. trade data.

Official December trade figures, due Thursday, are projected to show a $55.50 billion trade surplus. If confirmed, it would mark the first positive monthly trade balance for the United States since 1975. Trump also stated that the trade balance “will go into positive territory during this year,” reinforcing expectations of improved trade performance heading into 2026.

Despite recent improvements, the U.S. is still forecast to record a trade deficit exceeding $800 billion in 2025, compared with a record $1.2 trillion shortfall in 2024. Much of this year’s imbalance stemmed from a surge in imports during the first quarter, when businesses stockpiled goods ahead of Trump’s so-called “liberation day” tariffs introduced in April.

The goods trade deficit remains near historic highs at roughly $1.2 trillion. While tariffs ranging from 10% to 50% curbed imports—particularly from China, where shipments fell to $288 billion from $401 billion year-over-year—rising imports from other Asian and European nations partially offset those declines.

Zelenskiy Says Trump Pressuring Ukraine as Donbas Peace Talks Intensify

Zelenskiy Says Trump Pressuring Ukraine as Donbas Peace Talks Intensify  Make Japan strong again: Sanae Takaichi’s plan to transform her country’s military

Make Japan strong again: Sanae Takaichi’s plan to transform her country’s military  Lavrov Warns of Serious Consequences if U.S. Launches New Strike on Iran

Lavrov Warns of Serious Consequences if U.S. Launches New Strike on Iran  Asian Stocks Hit Record High as Strong U.S. Jobs Data Tempers Fed Rate Cut Hopes

Asian Stocks Hit Record High as Strong U.S. Jobs Data Tempers Fed Rate Cut Hopes  Asian Currencies Slip as Dollar Stabilizes Ahead of U.S. CPI Data

Asian Currencies Slip as Dollar Stabilizes Ahead of U.S. CPI Data  Democratic Senators Push Tougher Russia Energy Sanctions During Ukraine Visit

Democratic Senators Push Tougher Russia Energy Sanctions During Ukraine Visit  Hezbollah Rejects Lebanon Disarmament Plan as Government Grants Army Four-Month Timeline

Hezbollah Rejects Lebanon Disarmament Plan as Government Grants Army Four-Month Timeline  Asian Currencies Trade in Tight Range as Dollar Steadies; Yen Slips on Weak Japan GDP

Asian Currencies Trade in Tight Range as Dollar Steadies; Yen Slips on Weak Japan GDP  U.S. Troop Withdrawal from Syria Signals Shift in Counter-ISIS Strategy

U.S. Troop Withdrawal from Syria Signals Shift in Counter-ISIS Strategy  Trump Signals Indirect Role in U.S.-Iran Nuclear Talks as Tensions Rise

Trump Signals Indirect Role in U.S.-Iran Nuclear Talks as Tensions Rise  Yen Pulls Back After Rally as Fed Rate Cut Bets Support Dollar Stability

Yen Pulls Back After Rally as Fed Rate Cut Bets Support Dollar Stability  U.S. Stocks End Mixed as January CPI Cools, Treasury Yields Slide

U.S. Stocks End Mixed as January CPI Cools, Treasury Yields Slide  U.S.–Taiwan Trade Agreement Sets 15% Tariff, Boosts Energy and Semiconductor Investment

U.S.–Taiwan Trade Agreement Sets 15% Tariff, Boosts Energy and Semiconductor Investment  Vatican Declines to Join Trump’s “Board of Peace,” Urges UN to Lead Gaza Crisis Efforts

Vatican Declines to Join Trump’s “Board of Peace,” Urges UN to Lead Gaza Crisis Efforts  U.S. Stock Futures Edge Higher Ahead of Holiday as Investors Await Key Economic Data

U.S. Stock Futures Edge Higher Ahead of Holiday as Investors Await Key Economic Data  South Korean Court to Deliver Landmark Verdict in Yoon Suk Yeol Insurrection Case

South Korean Court to Deliver Landmark Verdict in Yoon Suk Yeol Insurrection Case  Oil Prices Edge Higher as US-Iran Tensions and Strong Payroll Data Shape Market Sentiment

Oil Prices Edge Higher as US-Iran Tensions and Strong Payroll Data Shape Market Sentiment