U.S. President Donald Trump intensified tensions with Colombia after announcing plans to raise tariffs and halt financial payments to the South American nation. The move follows a series of U.S. military strikes on vessels in the Caribbean that Washington claims were tied to drug trafficking.

Speaking aboard Air Force One, Trump accused Colombian President Gustavo Petro of being an “illegal drug leader,” alleging that Colombia was complicit in the narcotics trade. “They don’t fight drugs — they make drugs,” Trump said. His administration pledged to release details of the new tariffs soon, signaling a sharp deterioration in relations between Washington and Bogotá.

Petro, who has criticized U.S. strikes that reportedly killed civilians, condemned Trump’s remarks as “rude and ignorant,” insisting the bombed vessel belonged to a “humble family,” not a rebel group. Colombia’s foreign ministry denounced Trump’s comments as an affront to national dignity and vowed to seek international support in defense of its sovereignty.

U.S. Defense Secretary Pete Hegseth claimed on X that American forces destroyed a ship linked to the National Liberation Army (ELN), a leftist rebel faction, though he provided no evidence. The Pentagon declined further comment. The incident comes amid broader criticism from human rights organizations over the legality and humanitarian impact of recent U.S. military actions in the region.

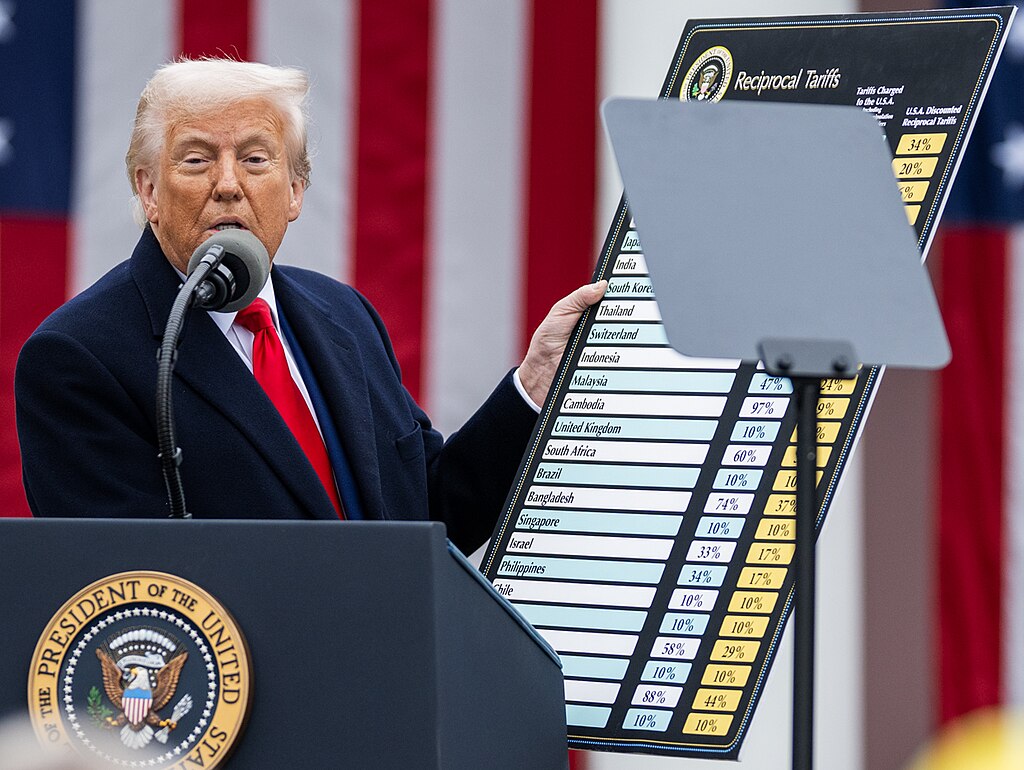

Colombia currently faces 10% tariffs on most exports to the United States, but Trump’s proposed increases could significantly impact trade. It remains unclear what specific aid programs will be affected, especially after the recent closure of USAID, once a major source of U.S. humanitarian assistance to Colombia.

The diplomatic fallout deepens an already strained relationship, as Colombia struggles to curb coca production and rebuild trust with Washington amid Trump’s aggressive anti-drug policies.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains