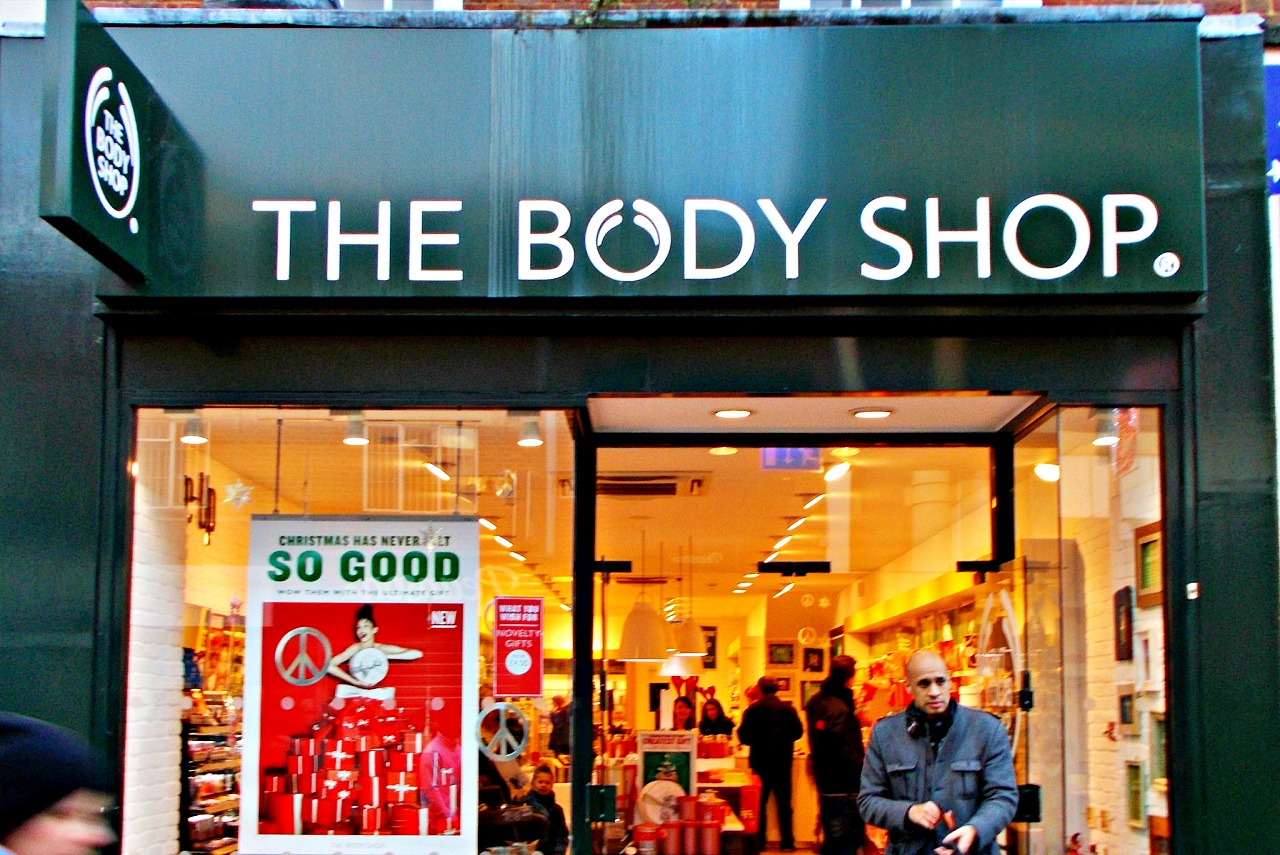

The Body Shop International Limited is in talks with the Aurelius Group for a possible acquisition deal. Based on the report, people familiar with the matter said the latter may buy the British cosmetic store chain.

The Aurelius Group Asset management company headquartered in Grünwald, Germany, may acquire The Body Shop from Natura & Co Holding SA. As per Bloomberg, the deal could be signed as early as November.

Aurelius Group’s Takeover Bid

The acquisition deal may be confirmed next month after other bidders, such as Alteri Investors and Elliott Advisors, were reportedly taken off the list and leaving Aurelius. The transaction could be valued between £400 million to £500 million.

According to Sky News, the first to publish the report, the ongoing negotiations between the companies are expected to result in an official buyout deal. It was during the summer when Natura & Co Holding placed The Body Shop on the market. In any case, it was said that Natura & Co. started to explore the sale to reduce costs after buying The Body Shop from L’Oreal in June 2017.

Aiming for the Completion of the Deal This Year

Currently, the firm hired Morgan Stanley to handle the transactions related to the acquisition. It was added that the main goal is to complete the deal before this year ends. Reuters reported that If the takeover of The Body Shop proceeds, the sale price may still be reduced and probably lower than the $485.20 million to $606.50 million suggested value.

At any rate, this buyout will further expand the Aurelius Group’s business portfolio after buying the Foortasylum streetwear and sportswear chain. The company bought this after the competition board ordered JD Sports to sell it. The Germany-based firm also owns the Lloyds Pharmacy group.

Photo by: Tony Monblat/Flickr (CC BY-SA 2.0)

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate