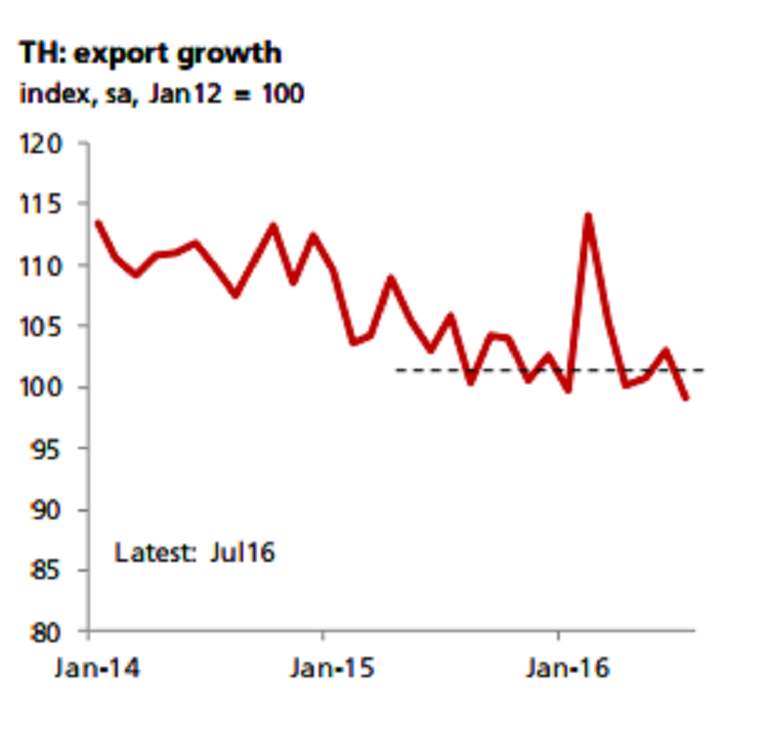

Exports growth in Thailand is expected to register a fourth straight year of decline in 2016 on existing downtrend in monthly exports, except for the temporary surge during the first half of this year, which can be attributed to exports of gold.

Expect export growth is expected to come in at -1.5 percent this year, making it the fourth consecutive year of decline. On seasonally-adjusted terms, monthly exports have been going sideways since early-2015. Exports of manufactured goods are also on course to fall by another 4 percent this year. This is likely to remain a drag on the manufacturing sector, which is a key driver of overall GDP growth.

Further, on a seasonally-adjusted term, monthly imports are now trending some 35 percent lower than the start of 2013. Private sector demand is seen growing at a mere 2.5 percent annual pace, well below its medium-term potential of about 4 percent. The government is helping to pick up the slack, but even the pace of government spending is likely to moderate going forward, DBS reported.

Meanwhile, reforms to lift productivity are crucial. Anecdotal evidence of Thai companies increasing their investment overseas should be noted. Once confidence in the domestic economy improves, higher domestic investment should follow, and this would gradually cut down the C/A surplus.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves