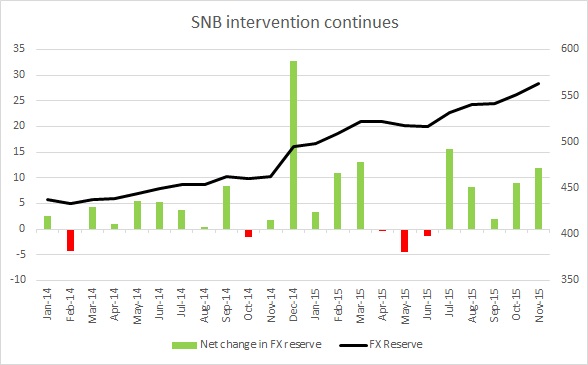

For the past month, looking at Euro/ Franc exchange rate, we have been speculating that Swiss National Bank (SNB) might be intervening in the market on regular basis to pop up Euro against Franc and to maintain some de-facto floor.

In January this year, SNB scrapped its Euro/Franc 1.2 floor, however seems to have maintained some de-facto floor around 1.02

Today's FX reserve details from SNB somewhat confirmed that theory. The average intervention has been highest this year, since 2011/12 Eurozone crisis. Last month SNB FX reserve increased by $16 billion, highest since July, as speculation over further monetary stimulus from European Central Bank (ECB), went rampant.

Since July SNB FX reserve increased by $49.8 billion or $9.4 billion per month. However with ECB providing lesser than expected stimulus, SNB balance sheet is likely to increase at much slower rate at least in first half of 2016.

SNB balance sheet size is now close to 90% of GDP.

Franc is currently trading at 1.002 against Dollar.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed