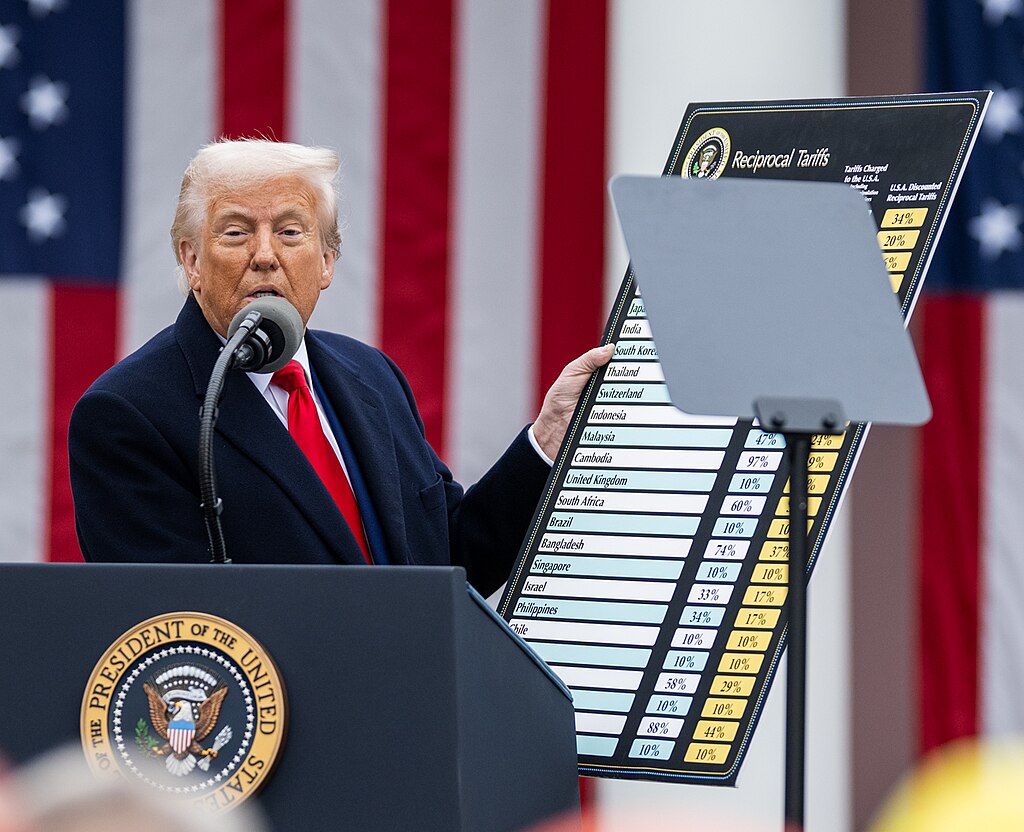

The U.S. dollar’s dominance faces renewed scrutiny as the Supreme Court prepares to examine whether President Donald Trump’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA) to impose tariffs was lawful. According to Macquarie economists, the ruling could have far-reaching implications for inflation, Federal Reserve policy, and the broader U.S. economy.

Macquarie noted that removing some or all IEEPA tariffs could revive disinflation trends, easing inflation expectations and allowing the Federal Reserve to pivot toward more rate cuts. The bank’s analysts estimated that without the new tariffs, consumer inflation in September would have been around 2.2%, compared to the reported 2.9%. A decision against the tariffs could weaken the U.S. dollar while initially pushing long-term Treasury yields higher.

At the core of the legal challenge is whether Trump’s reliance on the IEEPA grants him the authority to impose tariffs. Opponents argue that trade deficits do not constitute national emergencies, while Trump’s legal team insists that the president alone can declare emergencies tied to national security and foreign policy.

However, Macquarie warns that Trump’s own statements could undermine his defense. His decision to hike tariffs on Brazilian exports earlier this year, citing the “witch-hunt” against former President Jair Bolsonaro, might be used as evidence that the measures were politically driven rather than economic necessities.

If deemed illegal, the loss of tariff revenue—estimated at up to $2 trillion over the next decade—could widen the U.S. fiscal deficit by 2–3% of GDP. Still, analysts say the Court might strike a balance by limiting presidential emergency powers without entirely revoking tariff authority. The final ruling, expected between late November and early 2026, could significantly influence the dollar’s trajectory and future monetary policy.

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding

Federal Judge Rules Trump Administration Unlawfully Halted EV Charger Funding  Trump Administration Appeals Court Order to Release Hudson Tunnel Project Funding

Trump Administration Appeals Court Order to Release Hudson Tunnel Project Funding  Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition

Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Google Halts UK YouTube TV Measurement Service After Legal Action

Google Halts UK YouTube TV Measurement Service After Legal Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case

US Judge Rejects $2.36B Penalty Bid Against Google in Privacy Data Case  Federal Judge Signals Possible Dismissal of xAI Lawsuit Against OpenAI

Federal Judge Signals Possible Dismissal of xAI Lawsuit Against OpenAI  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility