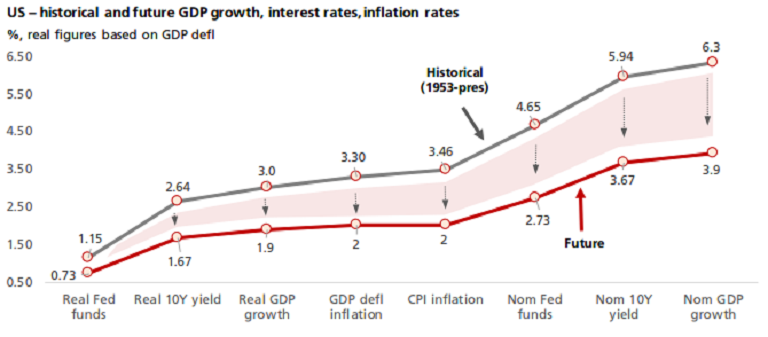

A slower rate of economic growth is expected to prevail in the United States for the next decade, while inflation is also likely to remain low too. Structural changes in growth and inflation mean structural changes in interest rates as well. Rates will be lower and spreads narrower.

Growth in gross domestic product (GDP) and inflation are both lower than they have been historically and will probably remain so for the next decade, perhaps longer. These structural changes mean 'neutral' interest rates; in simple terms, those that prevail through the ups and downs of the cycle, should be lower than in the past too, DBS reported.

Since 1953, real GDP growth has averaged 3.0 percent. Real 10-year yields have averaged 88 percent of that or 2.64 percent. But baby boomers are retiring and working-age population growth has fallen like a rock, down to 0.4 percent per year.

"We reckon that means potential GDP growth, again, that which would be expected to prevail through the cycle, has probably fallen to 1.9 percent per year, a full 1.1 percentage points lower than before," DBS commented in the report.

Meanwhile, Ten-year Treasury yields have risen to 1.82 percent as markets increasingly price in higher inflation and the likelihood of a December Fed hike; that is a rise of nearly 50 basis points in four months.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks