Samsung Electronics Co. Ltd (KS:005930) announced a stronger-than-expected profit forecast for the third quarter of 2025, fueled by surging demand for artificial intelligence (AI) technologies and a rebound in the global memory chip market. The South Korean tech giant estimated its operating profit at approximately 12.1 trillion won ($8.4 billion), surpassing market expectations of 10.1 trillion won, according to Reuters. This marks a solid increase from the 9.18 trillion won reported in the same quarter last year.

The company projected consolidated sales of 86 trillion won, up from 79.1 trillion won a year earlier, signaling a significant turnaround driven by the recovery in chip prices and growing global demand for high-performance computing solutions.

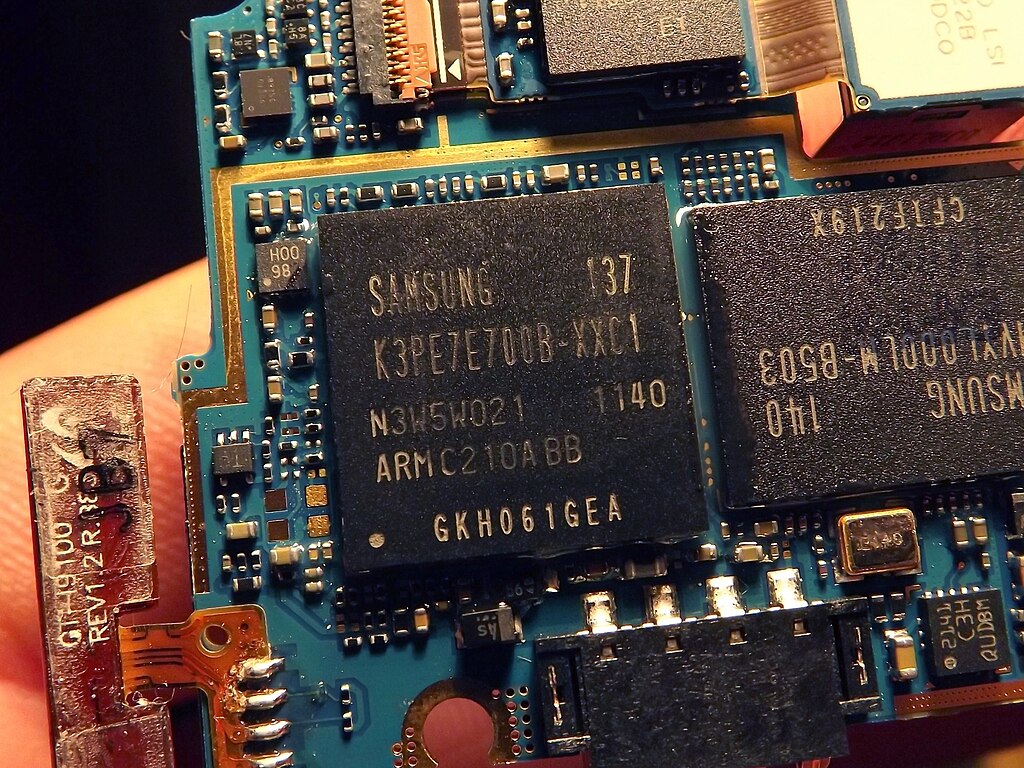

Samsung’s robust performance reflects a broad recovery in memory chip demand, particularly for AI-powered servers and high-bandwidth memory (HBM) chips. The company has benefited from the booming AI sector, as tech firms accelerate investments in advanced computing infrastructure. Demand for traditional DRAM and NAND flash memory products has also improved after a prolonged industry downturn over the past two years.

In a major strategic development, Samsung has reportedly cleared NVIDIA Corporation’s (NASDAQ: NVDA) performance requirements for HBM supply, paving the way for shipments to one of the world’s largest AI chip manufacturers. This milestone strengthens Samsung’s position in the competitive AI hardware market dominated by high-end memory solutions.

The company is expected to release its full third-quarter earnings report later in October, which will provide further insight into its performance across key business units, including semiconductors, mobile, and displays. With global AI investment continuing to surge, Samsung appears well-positioned to capitalize on the growing demand for next-generation memory technologies.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains