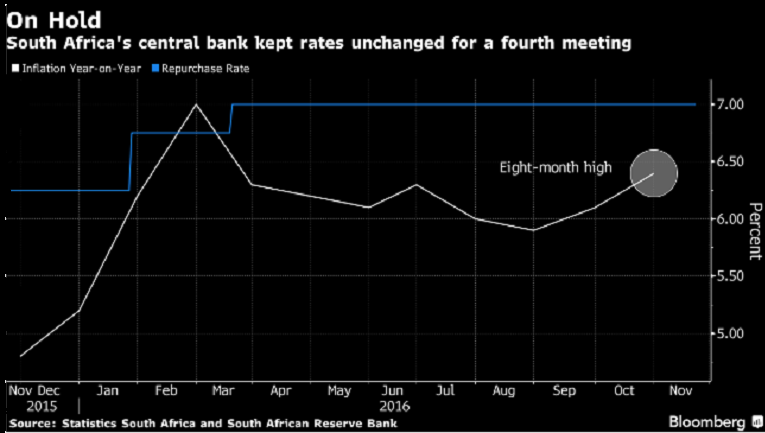

The South African Reserve Bank (SARB) remained on hold at the monetary policy meeting held Thursday, underlining weak domestic currency amid heightened risks from global uncertainty. Also, inflation remained below the central bank’s target range, compelling it to further not raise interest rates.

The six-member monetary policy committee (MPC), chaired by Governor Lesetja Kganyago, unanimously decided to take the neutral move; also, it did not discuss a rate cut move, nor did any of the members urge for a hike in the meeting. The MPC has remained on hold since the since March after raising it by 200 basis points since 2014 in a bid to limit price growth to between 3 percent and 6 percent.

Despite inflation picking up to an 8-month high to 6.4 percent in October, it is estimated to slow with the central bank’s target band of 3-6 percent by the second quarter of 2017. The MPC forecasts inflation will peak at an average of 6.6 percent this quarter and slow to 5.8 percent next year and 5.5 percent in 2018.

Moreover, the rand dropped to its lowest level, following news of President-elect Donald Trump’s victory in the 2016 US presidential election, on risks of a rise in government expenditure that could instigate a series of US interest rate hikes, posing serious downside risks to the import-dependent South African economy.

However, the SARB kept its economic growth forecast for the year unchanged at 0.4 percent. Output will expand at 1.2 percent in 2017 and 1.6 percent the year after, according to the MPC. Also, the rand will follow a volatile nature, in relation to the Federal Reserve decision in December. Although markets have fully priced in for a rate hike next month, uncertainties still prevail for South Africa.

Meanwhile, Moody’s has rated South Africa’s foreign-currency debt at two levels above junk, with a negative outlook, while S&P Global Ratings is yet to publish it outlook on December 2, but possesses a similar view with the lowest investment-grade level.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination