Amid structural and cyclical forces, the Indian rupee has depreciated dramatically against the US dollar over the past two weeks, floating near an all-time low of 88.78–88.80. With Foreign Institutional Investors (FIIs) removing a record Rs 1.98 lakh crore from Indian stocks in 2025, including Early October saw Rs 5,235 crore, extending 21 months of net selling totaling Rs 3.19 lakh crore; September's figure was Rs 27,163 crore. This constant capital outflow has damaged investor faith and increased currency volatility.

Adding to the burden, the US's 50% tariff on Indian goods, effective August 27, 2025, has reduced export competitiveness, thereby affecting $50 billion in commerce—especially textiles, jewels, Per World Bank estimates, jewelry and seafood—but they compromise growth and earnings forecasts. The Reserve Bank of India (RBI) is aggressively defending at the 88.80 mark via fierce dollar sales in spot and forward markets, in addition to liquidity-managing swaps, restricting daily movements under 10 paisa. Still, the vicious cycle of India's trade deficit is growing because of tariff-hit exports and more expensive imports; this is intensifying persistent current account demands and pointing to greater economic vulnerabilities.

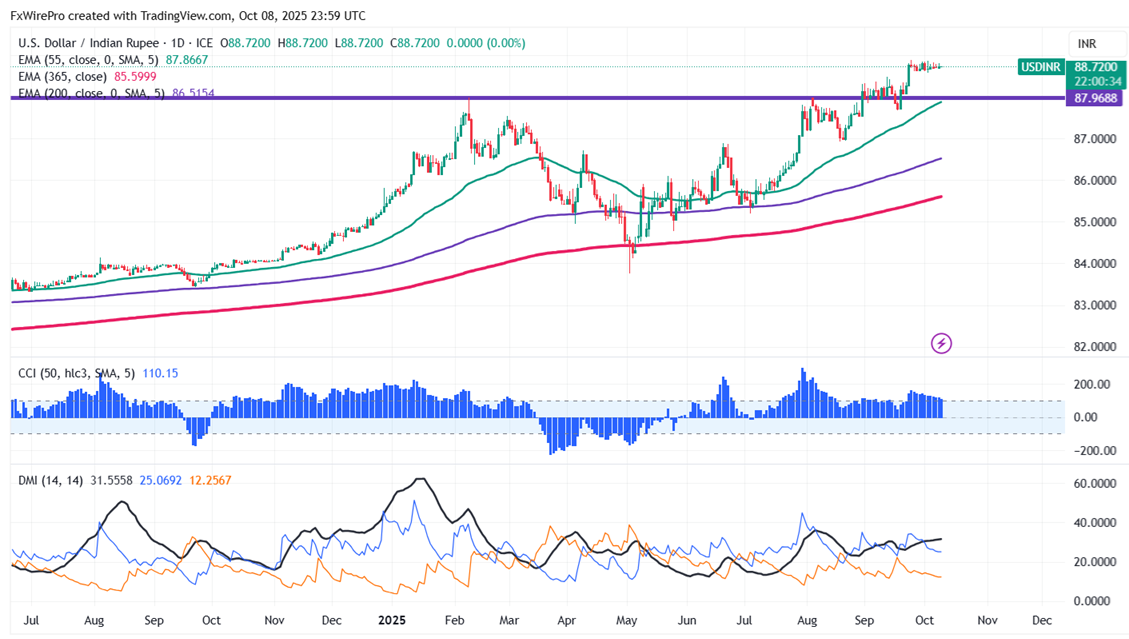

USDINR is consolidating after hitting a lifetime high of $88.87. It hit a low of 88.57 this month and is currently trading around $88.72.

.

Technicals-

Major resistance- 88.90,90

Near-term support - 88.20/87.65

Minor support- 86.50, 85.60

Trend reversal level- 83