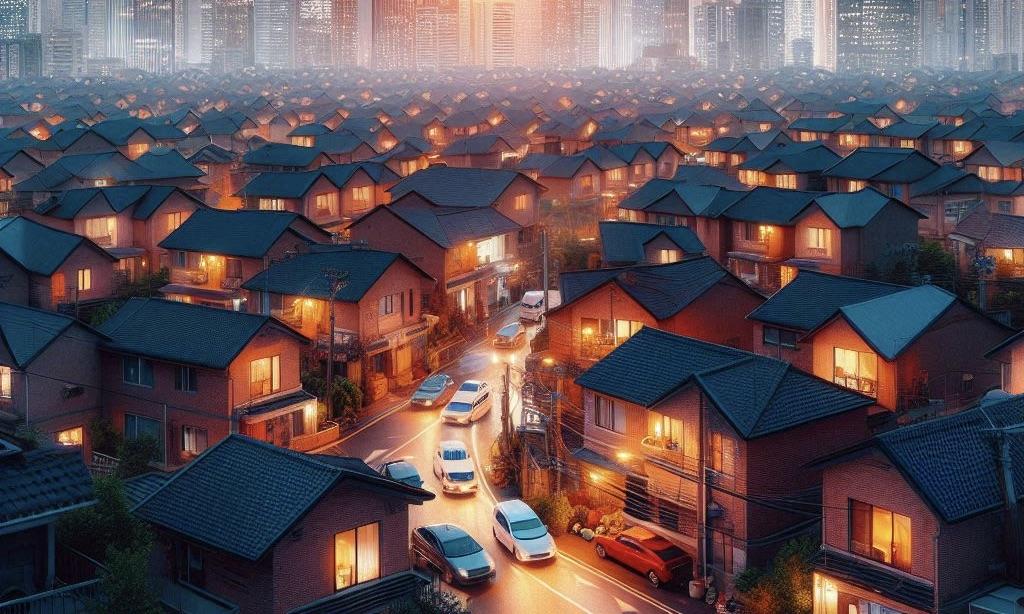

South Korea’s household debt surged last quarter, reaching 1,896 trillion won, as mortgage loans soared by 5.9%. This increase is likely to deter the Bank of Korea from considering an interest rate cut when it meets on August 22, amid concerns over financial imbalances and rising home prices.

South Korea’s Accelerating Household Debt Likely to Keep Bank of Korea’s Rate Hike On Hold

The central bank is anticipated to refrain from indicating a near-term policy shift when authorities convene later this week, as the most recent dataset in a series of datasets shows that South Korea's household debt expanded at an accelerated pace last quarter.

The Bank of Korea announced on August 20 that total household credit increased by 1.9% from the previous year to 1,896 trillion won ($1.43 trillion) in April-June. Mortgage loans, the primary source of credit, increased by 5.9% in the prior year, reaching 1,093 trillion won.

In conjunction with an earlier BOK survey that indicated that consumers anticipate a further increase in the housing market's temperature, credit data on August 20 is expected to reinforce the consensus among economists that monetary authorities will maintain the benchmark interest rate at 3.5%, a level that is considered restrictive, when they meet on August 22.

Rising Household Debt and Seoul’s Housing Prices Fuel BOK’s Concerns Over Financial Imbalances

Last month, BOK Governor Rhee Chang-yong expressed apprehension regarding the rise in household debt, exacerbated by the continuous increase in home prices in Seoul, thereby increasing the likelihood of financial imbalances. Numerous individuals maintain most of their wealth in real estate, resulting in South Korea's household debt-to-economy ratio being among the highest in the world.

Although many economists anticipate the BOK reducing its rate in October, this prediction may be postponed if the housing market continues to exhibit warming symptoms beyond August. According to Yahoo Finance, this uncertainty and an export rally driven by artificial intelligence processors bolster policymakers' confidence in the economy's ability to continue operating despite restrictive policy settings.

On a separate note, the Financial Services Commission of South Korea announced on August 20 that the mortgage loan limit for residences in the greater Seoul area will be reduced beginning September 1. With its potential to discourage private lending, this action underscores the gravity of the situation and the caution that needs to be exercised in the future of private lending.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility