The Reserve Bank of Australia (RBA) is expected to hold its first monetary policy meeting of 2017 on February 7, where it is widely expected to maintain its bank rate at a historic low of 1.50 percent despite global uncertainties. The RBA began its current easing cycle in November 2011 and over the course of the last five years, has dropped the cash rate from 4.75 percent all the way to its current 1.50 percent.

Minutes from the December board meeting emphasised the concern the Board has with balancing the risks around financial stability and the possible need to further support a deteriorating economy. Minutes put a positive spin on the current economic outlook and analysts suggest the "hurdle" to further cutting rates is high.

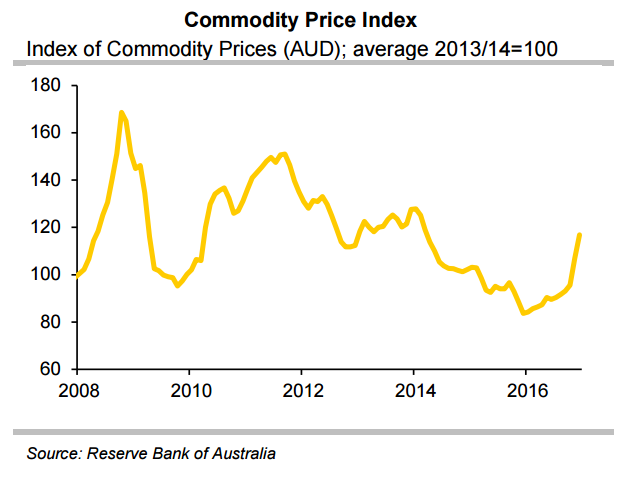

Evidence now is increasingly pointing towards a positive transition point for nominal growth, inflation and wages. Australia's NAB survey showed business conditions bounced solidly in December following a string of declines. Business confidence which has been tracking sideways over the past year also nudged up.

Labour costs were reported to have risen 0.6 percent in the three months to December. While this is down slightly from the previous month’s rise of 0.7 percent, the average read in the three months to December was 0.7 percent compared with 0.6 percent in the three months to December 2015, suggesting that wage inflation is slowing picking up. If downside tail risks continue to subside and broader momentum improves as expected, RBA's next policy move will be 25 basis points hike in the first-quarter of 2018.

Australia Q4 inflation data released last month showed Australia’s underlying inflation rose by +0.4 percent for the quarter and +1.55 percent for the year, a touch weaker than expected, but in line with the RBA’s 1½ percent/yr target. The closely watched core inflation figure was 1.6 percent for the year, and 0.4 percent for the quarter. Inflation has lagged below the RBA's 2-3 per cent target band since late 2014 and numbers highlight the downside risks.

FxWirePro's Hourly AUD Strength Index remained neutral at -10.9947 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook