As inflation expectations rise globally, the US Federal Reserve is expected to hike rates at a faster pace next year. Last week, FOMC forecasted 3 rate hikes, compared to just one each in previous two years. Then why the governments are still able to sell bonds at negative rates? Last Friday, the United Kingdom for the first time sold bonds at negative rates. The government was able to borrow £1 billion at minus 0.1038 percent. The negative bond universe is squeezed but still close to $10.8 trillion. In August, this universe was as big as $13 trillion.

Part of the answer lies with Quantitative Easing. Several major central banks around the world are still pursuing quantitative easing. The European Central Bank (ECB) earlier this month announced a further purchase of €540 billion bonds till December 2017, once the current program expires in March 2017. Not only that, the ECB announced that it would now purchase below the deposit rate, which is at -0.4 percent. Since the ECB announcement, German 2-year yield has been declining to record low and currently trading at -0.8 percent.

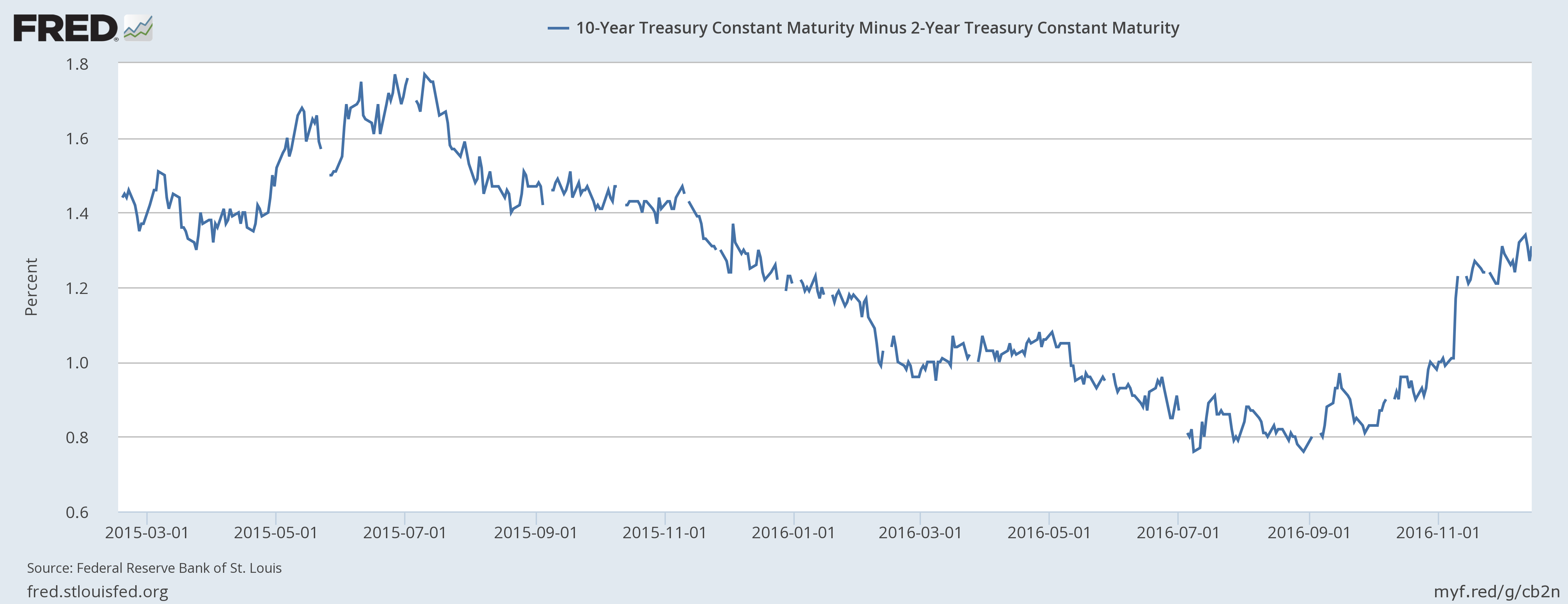

With rising inflation expectation globally, the market is and will return to the very fundamental that the central banks can control the short term rates but have hardly any control over the longer end of the curve, which gets determined by a variety of factors in the economy. The spread between the US 2-year and 10-year treasury has jumped by 56 basis points since September to 1.32 percent.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed