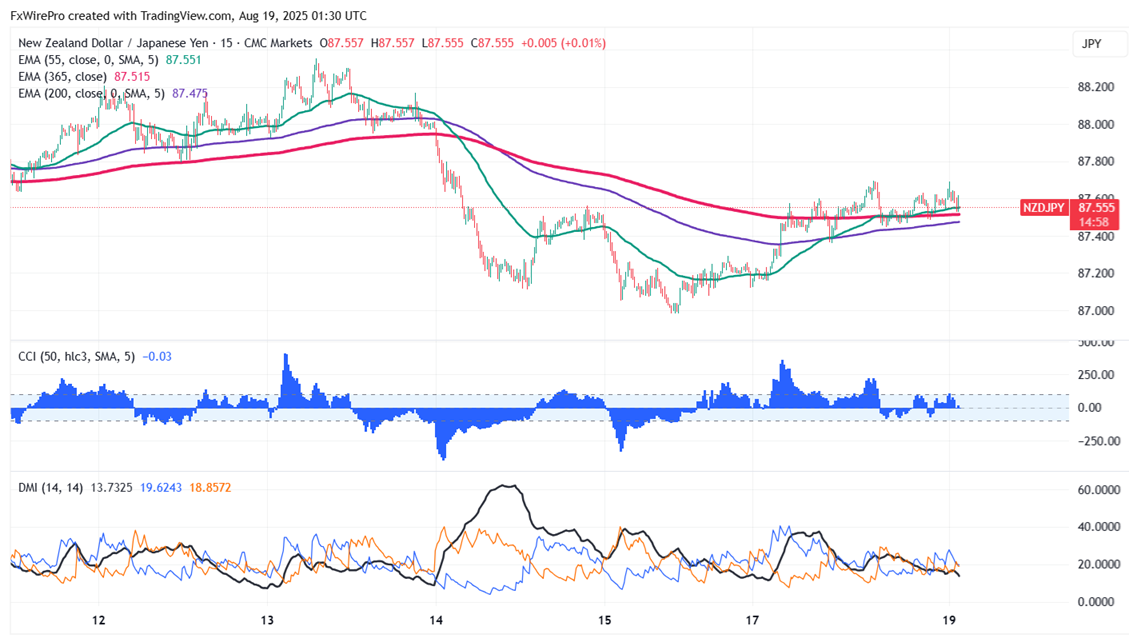

Intraday trend remains neutral as long as the resistance at 87.70 holds. The pair trades in a narrow range ahead of the RBNZ monetary policy tomorrow. It hits an intraday high of 87.69 and is currently trading around 87.56. The overall bearish trend is intact as long as resistance 89.20 holds.

Tomorrow, the Reserve Bank of New Zealand is expected to lower the Official Cash Rate by 25 basis points to 3.0%, thereby continuing its easing cycle following July's break. Forward guidance will probably stress a data-dependent approach for future cuts, with the door open but prognosis unknown.

Technicals-

The pair is trading above the 34 and 55 EMA on the 15-minute chart.

The near-term resistance is around 87.70, a breach above targets 88/88.60/89/89.60/90. The immediate support is at 87.40; any violation below will drag the pair to 87/86.30/85.10/84.06.

Indicator ( 15-min chart)

CCI (50)- Bullish

Average directional movement Index- Neutral. All indicators confirm a mixed trend.

It is good to buy above 87.70 with SL around 87.40 for TP of 88.59/89.