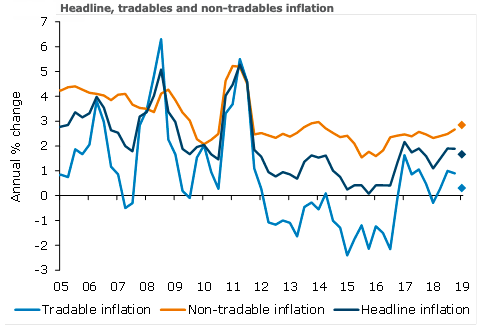

New Zealand’s headline consumer price inflation is expected to rise 0.3 percent in the March quarter, with annual inflation slipping from 1.9 percent to 1.7 percent. Tradable inflation is expected to print at -0.6 percent q/q, while non-tradable inflation is expected to post a 1.1 percent q/q rise, according to the latest report from ANZ Research.

CPI in line with expectations would add to the case that a cut in the Overnight Cash Rate (OCR) is not a matter of urgency. The Reserve Bank of New Zealand (RBNZ) would likely take some comfort from stronger domestic inflation (lifting from 2.7 percent y/y to 2.8 percent), with weakness concentrated in the relatively volatile and transitory tradable component.

However, the medium-term outlook for domestic inflation remains troubling. The central bank needs to see accelerating GDP growth to achieve a sustained lift in inflation, and by August it is expected to be clear that an OCR cut is required to support this.

Further, non-tradable inflation is expected to post a 1.1 percent q/q rise, consistent with the RBNZ’s February expectations. This would see annual non-tradable inflation increase from 2.7 percent to 2.8 percent.

The strong non-tradable print comes from seasonal strength in regulated prices, such as tobacco and education, as well as increases in housing-related prices. Core inflation has increased over the past year, but the suite of core measures is seen to track broadly sideways from here.

"While we are expecting a lift in non-tradable inflation next week, the medium-term outlook remains troubling. The economic expansion is losing steam, the global environment is no longer a tailwind, and the peak in capacity pressures appears to be behind us. Domestic inflationary pressures appear fragile, with early signs of waning capacity and cost pressures. The RBNZ needs to see accelerating GDP growth to achieve a sustained lift in inflation, and they are running out of growth drivers to achieve this," the report added.

Image Courtesy: ANZ Research

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data