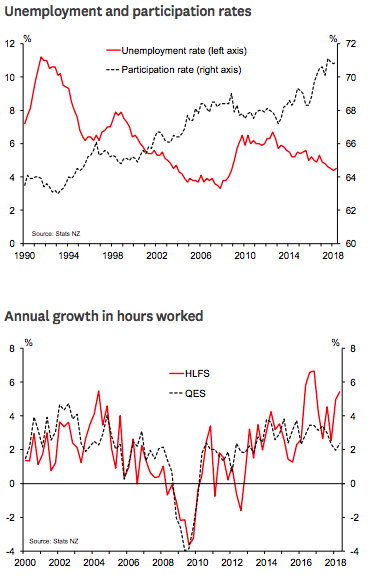

Labour market conditions were generally firmer in the June quarter. Jobs growth was robust, though the unemployment rate ticked up slightly. With the economy moving closer to full capacity, the first signs of a stirring in wage growth are finally emerging.

While the results were stronger than what was expected, they were largely in line with the Reserve Bank of New Zealand’s (RBNZ) forecasts in its May Monetary Policy Statement. The only aspect that fell short was the rise in the unemployment rate, and that was well within the margin of error for this survey.

"We think the RBNZ will be satisfied with both its contribution to “supporting maximum sustainable employment” – as specified in its new dual mandate – and with the evidence that inflation pressures are gradually picking up as intended," Westpac Research commented in its latest report.

Meanwhile, the labour market figures are perhaps best seen as a corrective to the pessimism seen in recent business confidence surveys. Growth in activity has slowed from its peak, but businesses have remained open to hiring. And while wage growth has picked up, it’s not spiralling higher in the way that businesses seem to fear.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom