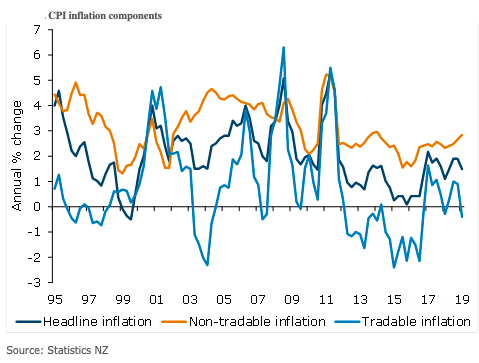

New Zealand’s CPI increased 0.1 percent q/q in Q1 2019, below the 0.2 percent q/q rise incorporated in the RBNZ’s February MPS, and below ANZ and market expectations. Annual inflation dipped to 1.5 percent y/y, from 1.9 percent.

However, the details of the release add to the case that a cut in the OCR is not a matter of urgency. The RBNZ will take some comfort from stronger domestic inflation, as expected (+1.1 percent q/q), with weakness concentrated in the relatively volatile and transitory tradable component (-1.3 percent q/q).

Today’s print for CPI inflation was slightly below the 0.2 percent q/q rise incorporated in the RBNZ’s February MPS. But the details of the print were broadly in line with their expectations, with volatility in tradable prices driving the RBNZ miss.

Looking forward, a lower NZD should start to feed more fully into tradable prices, and oil has already rallied 50 percent from the December low. This will result in a higher tradable inflation forecast in the May MPS, limiting any perceived risk of lower inflation expectations affecting pricing, ANZ Research reported.

Most importantly, non-tradable inflation was bang on the RBNZ’s expectation. While inflation is a lagging indicator, the RBNZ will take a degree of comfort from the fact that non-tradables is at its highest level in five years, with weakness concentrated in the volatile and transitory tradable component.

A large proportion of the quarterly pick-up in non-tradable inflation was due to regulated prices (tobacco and education). Core inflation measures tracked broadly sideways, continuing to stabilise following strength earlier in 2018.

Meanwhile, the annual 30 percent trimmed mean dipped a touch to sit at 1.9 percent. The weighted median was stable at 2.2 percent y/y, and inflation excluding food and energy remained at 1.5 percent. The focus now turns towards the RBNZ’s sectoral factor model for confirmation of the stable core inflation signal.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target