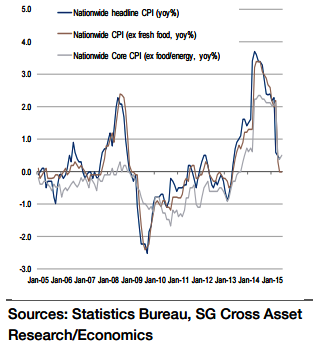

There will be a base effect due to last year's rise in oil prices that continued through to mid-2014. Although the BoJ is aiming at achieving a 2% price stability target, Japan CPI (excluding fresh food) likely fell below 0% yoy, its weakest point since April 2013.

"Japan's nationwide CPI (excluding fresh food) likely fell to -0.2% yoy in July (was +0.1% yoy in June). Factors such as the passing on of price increases to products as a result of costpush inflation caused by yen depreciation and the recovery in domestic demand are helping to push up inflation", says Societe Generale.

Since April, the effects of upward pressure on wages have been getting stronger due to the improved balance of labour supply and demand. In Q4, the base effect due to the fall in oil prices will also fade out. As a result, prices will pick up on a yoy basis. However, oil prices have fallen again since July.

Moreover, the main cause of the negative Q2 GDP growth was weak consumption. It would seem that consumers have not yet recovered completely from the deterioration of consumer sentiment after the consumption tax (CT) hike in April 2014, especially as food prices are continuously increasing. As a result, consumers have been defensive.

More stagnant inflation for Japan in July

Wednesday, August 26, 2015 4:35 AM UTC

Editor's Picks

- Market Data

Most Popular

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure