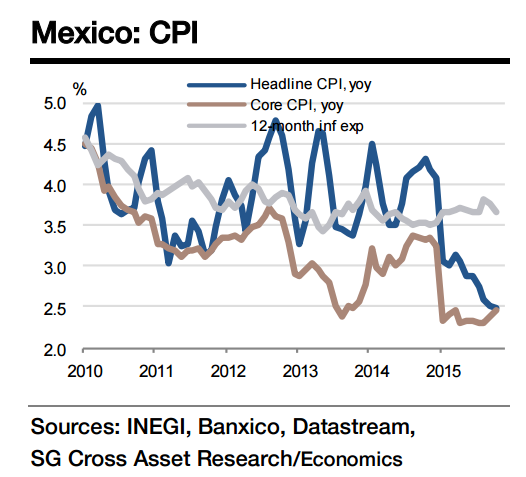

While the headline inflation rate has slipped further over the past couple of months, core inflation has moved up from 2.3% yoy in August to 2.47% yoy in October on the back of a rise in inflation in categories such as health and personal care, apparel, and furniture and domestic accessories.

Also, dwelling inflation - the key factor behind the sharp decline in inflation earlier this year - has moved up to 0.58% yoy from 0.45%. Mid-month inflation is expected to moderate to 2.47% yoy in November. In sum, core inflation has remained low, while stabilising or even rising, and the weakness in the headline inflation has been driven primarily by the food and transport segments. October and November data should hint that the deceleration (and critically, food inflation) is in last leg and that we will see it move above Banxico's target in January 2016.

Inflation should revert to its medium-term trend in 2016 when the base effect of lower telecom and energy prices ebbs. Essentially, the inflation situation remains conducive to Banxico's current accommodative stance, and growth and the Fed's stance are likely to be the key factors in monetary policy decisions over the next couple of quarters.

Mexico inflation remains low on food and transport prices; core inflation rising

Tuesday, November 24, 2015 12:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022