Data released by the federal Department of Statistics on Wednesday showed that Malaysia's consumer prices rose at a slower-than-expected pace in June. Seasonally adjusted headline inflation fell 0.2 percent month-over-month in June, the fourth consecutive monthly decline. Consumer prices in June rose 3.6 percent from a year earlier, lower than forecasts for an unchanged 3.9 percent.

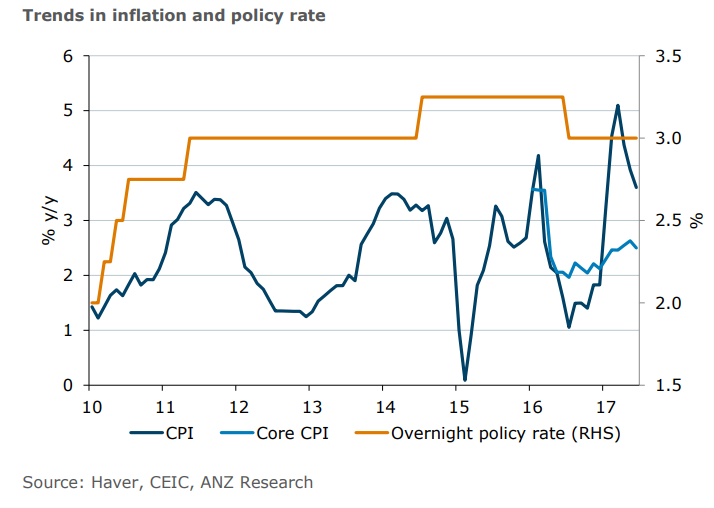

The fall was driven mostly by costlier fuel and food, with the transport index rising 10.5 percent from a year earlier, according to data from the Statistics Department. Core inflation, which excludes most volatile items such as fresh food and energy prices, rose 2.5 percent in June compared to the same month last year, a slight moderation from a level of 2.6 percent in the previous month.

Last week, Bank Negara Malaysia (BNM) held the key Overnight Policy Rate at 3.00 percent on expectation that inflation rate may ease in the second half of the year, while economic growth picks up pace. Overall, the evolution of inflation is consistent with BNM’s anticipated trajectory. Today's data will likely bolster the central bank's view that inflation rate will further moderate later this year and will allow the central bank to focus mostly on risks to domestic economic growth.

"June’s inflation print does not make a case for a change in the overnight policy rate. Apart from the fact that the inflation trajectory is in line with BNM’s expectations, we suspect that BNM would be keen to see the real policy rate returning to positive territory. This, in turn, should enhance ringgit stability," said ANZ research in a report.

USD/MYR was trading at 1.2810 at the time of writing, down 0.07 percent on the day. Upside was capped at 5-DMA at 4.2865. Price action is below daily cloud and major moving averages. We see scope for further downside. Test of 4.2530 levels likely. At 1140 GMT, FxWirePro's Hourly USD Spot Index was bearish at -98.8764 levels. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says