As large MXN sell-off following the U.S. Presidential Elections fueled inflation fears, Banxico raised its overnight rate by 50bps to 5.25 percent in line with market expectations at its November 18th policy meeting. In its policy statement, Banxico indicated that the growth outlook has deteriorated and warned that volatility is likely to persist amid uncertainty with respect to bilateral relations with the United States following Trump's victory.

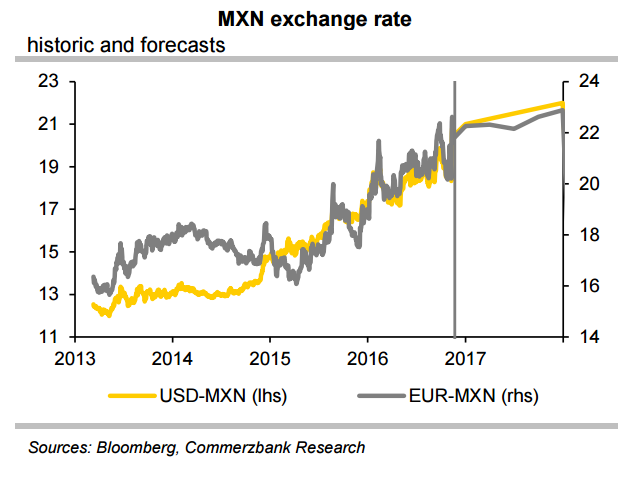

The Peso nose-dived, collapsing as much as 17 percent reaching an all-time low of 21.20 per US Dollar on November 11. The decision to hike rate was a direct effort to stabilize exchange rate in order to check capital flight and prevent inflation expectations from becoming unanchored. Consumer prices in Mexico are just starting to rise as seen in Oct CPI which was up 3.06 percent y/y from 2.61 percent y/y at the beginning of the year.

Trump’s victory and uncertainty about the future US policy should tend to further depress sentiment in the Mexican economy. USA is by far the most important trading partner for Mexico and should Trump intend to tamper with NAFTA (free-trade agreement between Mexico, the US and Canada), Mexico’s foreign trade could be adversely affected.

Consumer prices have long been moving in the bottom half of the central bank’s target corridor. Political uncertainty and restrictive fiscal and monetary policies will probably impose a drag on the Mexican economy next year and should constrain inflation pressure.

Despite rate cuts by the central bank on three separate occasions during 2016 (February, June & September), MXN was unable to swerve off its depreciatory trend and the moves proved to be ultimately ineffective. Trump’s election has made Banxico's job much more difficult. Speculation about a more restrictive Fed adds additional pressure on the peso. Banxico is likely to track the Fed in its rate hikes.

"We expect another 50bp rate hike for December. We expect the peso to depreciate to 22 against the USD over the course of next year," said Commerzbank in a report.

USD/MXN was trading at 20.65 at around 1100 GMT. At the said time, FxWirePro's Hourly USD Spot Index was at -98.5145 (Bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength