The Bank of Canada today hiked its interest rate by 25 bp to 1.00%. This took the market by surprise – CAD rallied sharply with USDCAD falling below 1.22. Since May, CAD has appreciated by more than 12% against USD. We fear that this will weigh on already lackluster price developments and slow down the economic recovery.

The BoC hiked its interest rate yesterday for the second time following the surprise rate hike of July. Thus the BoC has reversed the two rate cuts in response to the sharp oil price decline of 2014/ 2015. The BoC’s argument this hike is the same as that for the rate cuts back in 2015: the economic performance justifies a corresponding interest rate adjustment. The BoC argues in its statement that “Recent economic data have been stronger than expected, supporting the Bank’s view that growth in Canada is becoming more broadly-based and self-sustaining.”

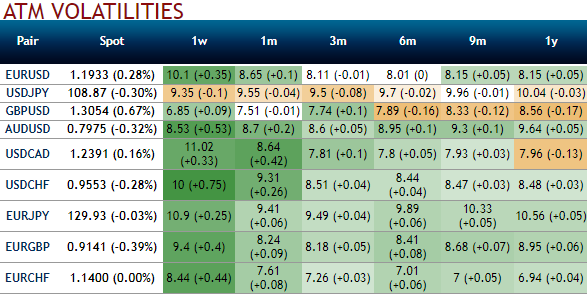

But OTC functions for USDCAD has been increasing, you could easily make out the gaining traction in mounting IVs (highest among G10 FX space, refer 1w tenors).

Please refer below weblink for our write up on USDCAD technical analysis, we managed to achieve our 1st target, now is on the verge of 2nd target:

The CAD ranks halfway down the table of best performers in G10 this year against the USD having gained 10.2%, trailing the SEK (14.4%) and the EUR (13.3%).

However, the CAD has only recovered 10% from the early 2016 lows in real terms which leave it 16% below 2011 high when WTI crude traded at $114/bbl.

In other words, though the normalization of policy in Canada is more advanced than in most other G10 countries, one should not get carried away and hope for USDCAD to quickly revisit levels closer to 1.00 without a marked up lift in crude oil prices.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One