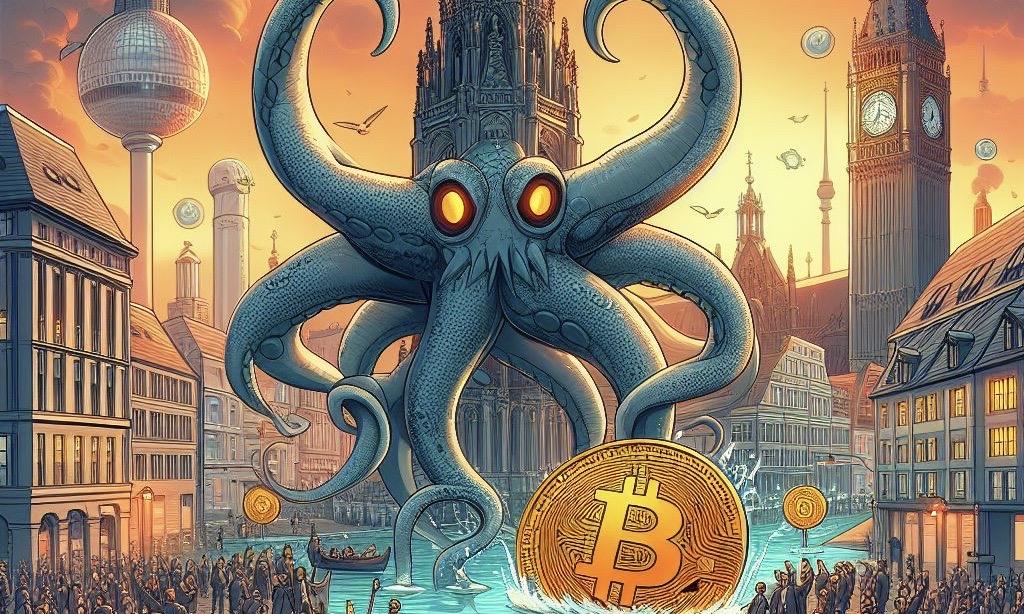

Cryptocurrency giant Kraken makes waves with its strategic decision to launch operations in Germany, a pivotal move in its broader European expansion plan. Teaming up with DLT Finance, a regulated financial institution, Kraken aims to offer tailored crypto solutions to meet the diverse needs of German investors.

Kraken's German Expansion

In a stunning development, Kraken, a worldwide known CEX, recently announced plans to begin operations in Germany as part of its European expansion, Coingape reported. In collaboration with DLT Finance, a regulated financial institute and custodian for digital assets, the CEX intends to provide various innovative crypto products, each adapted to German clients' specific needs and preferences.

This move by the cryptocurrency exchange is an attempt to broaden its global footprint. Let us take a closer look at the company's official announcement.

On May 6, Kraken said that it wants to establish a presence in one of Europe's important markets, Germany, through cooperation with DLT Finance. Furthermore, beginning July 10 of this year, the business plans to present a nationwide stockpile of cryptocurrency-related services.

DLT Finance, a subsidiary of the well-known BaFin-licensed crypto services providers DLT Securities GmbH and DLT Custody GmbH, aims to change the German crypto market.

Once the agreement is operational, DLT Finance will streamline specifically designed skills and infrastructure to meet the demands of millions of Germans and provide secure and compliant crypto services.

Kraken CEO David Ripley commented on the relationship: "Collaborating with industry-leading partners is a critical aspect of our objective to drive the worldwide adoption of cryptocurrency. With over 5% of Germans already owning crypto assets, we are confident in the potential of our innovative product suite." He also stated that "along with excellent local language client service support - will be appealing to prospective clients as crypto continues to become more mainstream across Europe."

Strategic Partnership

As reported by CoinGape Media earlier this year, Kraken even obtained a Virtual Asset Service Provider (VASP) registration from the Dutch Central Bank. This is consistent with CEX's European expansion objectives, as the company now has legal rights to offer its top-tier crypto services to Dutch residents.

Meanwhile, this story appears to have fueled the global rivalry between recognized cryptocurrency exchanges.

Photo: Microsoft Bing

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine