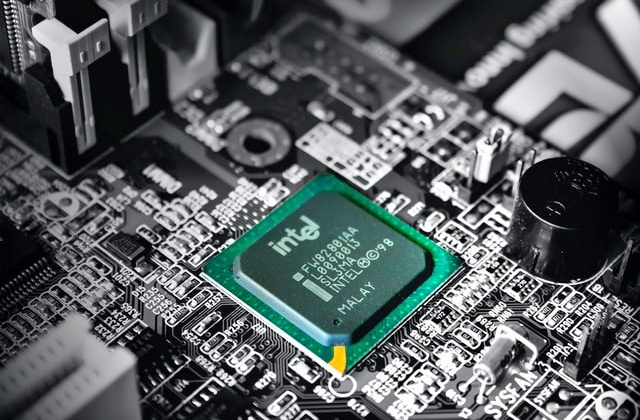

Intel is setting up a chip factory in Europe with an investment of around $95 billion, and it has finally chosen a location. An insider revealed that the company would be making a formal public announcement about its decision on March 4.

As per Reuters, Intel Corporation said in September of last year that it has plans of investing billions in Europe over the next decade. The chipmaker mentioned it is considering two locations, but there was no announcement even by the end of 2021.

Now, it was finally revealed it had chosen Magdeburg City in east Germany as the new ground for its chip factory in Europe. Since the beginning, Germany has been part of the locations being considered alongside Penzing in Bavaria and another German region, in Dresden.

Based on the observation of analysts, it may have taken some time for Intel to pick a place for its new semiconductor plant because it could be waiting for the launch of new legislation related to the chips business. It was explained that the European Chips Act is being introduced to lessen the region’s dependence on chips supply from suppliers in Asia.

Europe is said to be subsidizing the local development of major semiconductor factories to attain its goal of having its own source of advanced chips in its own territory.

In any case, it was reported that Intel’s chief executive officer, Patrick Gelsinger, ultimately chose Magdeburg based on some factors, including stability, government subsidies, and the skilled workers in the area. In addition, Germany also houses some of the largest automakers in the world that were also badly hit by the global chip shortage. While the location for Intel Corporation’s European chip factory was already confirmed, it was not mentioned when the chip production could begin.

Finally, Tom’s Hardware reported that based on estimation, Intel’s plant in Magdeburg is set to open more than 1,000 new jobs and will hire locals for well-paid positions. Intel will be employing IT talents that are said to be highly available in the area. Once the factory is in operation, the locality will also be benefitting from the business it will bring.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm