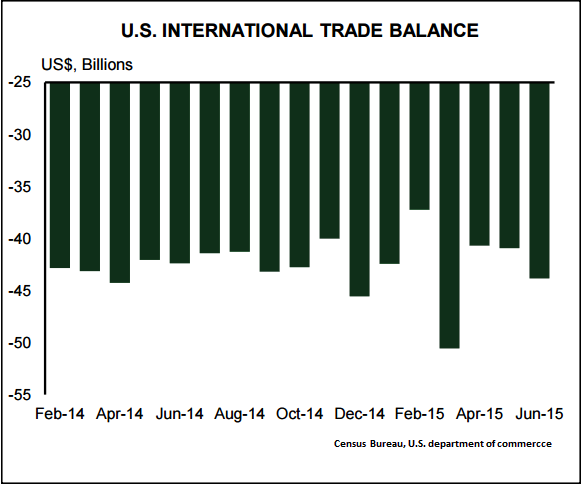

The US trade deficit is projected to turn down remarkably in July, narrowing to $41.81B from $43.84B the month before, with import activity falling on account of falling energy prices while export activity should rise modestly. This will mark the first improvement in the deficit since April.

Earlier post was up about $2.9 billion from $40.9 billion in May, revised. June exports were $188.6 billion, $0.1 billion less than May exports. June imports were $232.4 billion, $2.8 billion more than May imports.

But this time, export activity should rise on the month, posting a 0.4% MoM advance, bolstered in large part by improving global demand. Import activity is likely to decelerate by 0.55% MoM in July as the continuation of the decline on oil prices dampens the import bill.

In the coming months, we expect the improvement in the trade balance to be sustained as lower energy prices continue to keep the energy import bill low, but expect a stronger USD to weigh on exports.

Release Date: September 3, 2015 June Result: -$43.8B TD Forecast: -$41.8B Consensus: -$44.5B.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient