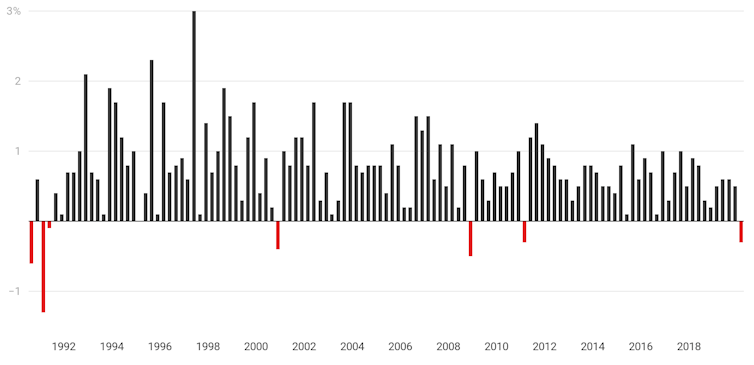

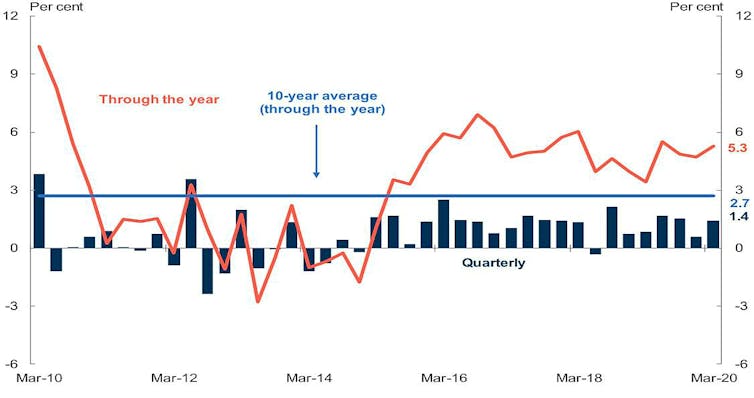

A go-slow on spending sent the economy backwards 0.3% in the first three months of this year, only the fourth such decline since Australia was last in recession in the early 1990s.

Treasurer Josh Frydenberg says treasury has told him that the next three months, the June quarter that we are in at present, will see a “far more severe” contraction, one private sector forecasters believe could be as high as 10%.

Asked whether that meant Australia was already in recession, he said it did.

Quarterly GDP growth since 1990

Most unusually for an economic downturn, household incomes rose throughout the quarter, pushed higher by a 6.2% increase in government payments related to COVID-19 and the bushfires, and an 11.1% increase in insurance payouts as a result of bushfires and hailstorms.

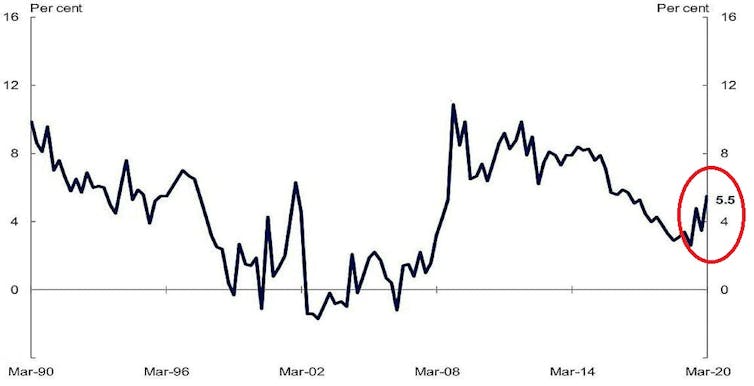

But rather than spend most of it, Australian households dramatically increased saving in the quarter, pushing the household saving ratio up from 3.5% to 5.5% and pushing down household spending 0.2%.

Household savings ratio

Commonwealth Treasury

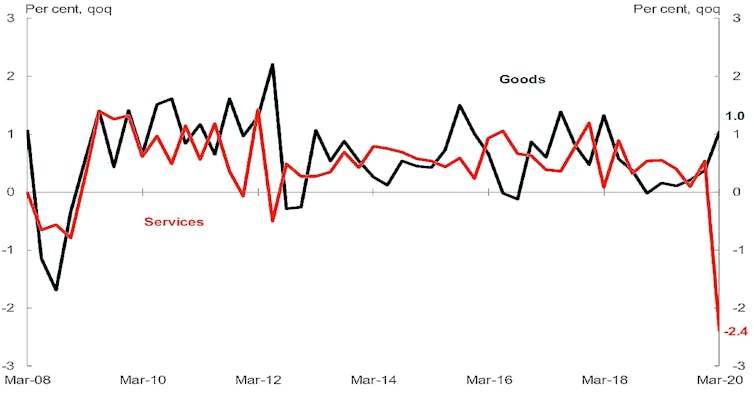

Spending on goods actually increased over the three months as Australians stocked up on essentials including toilet paper in March.

The production of “petroleum, coal, chemical and rubber products” surged 8.1% as consumers stocked up on cleaning and disinfectant products.

But spending on services plummeted, led down by dramatic falls in spending on transport and hotels, cafes and restaurants.

Household consumption, March quarter

Commonwealth Treasury

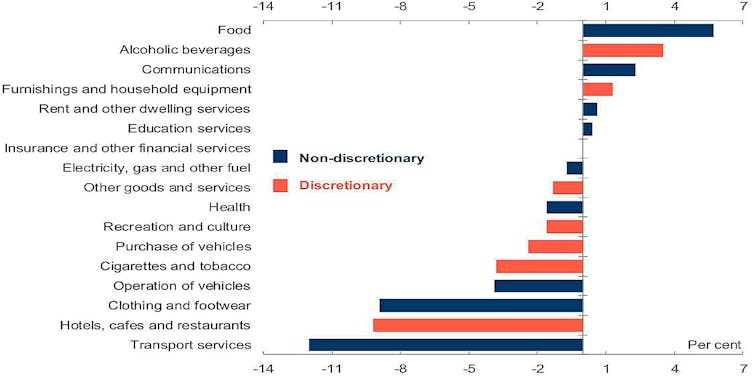

Spending on transport services (airlines and the like) fell 12.0%. Spending on hotels, cafes and restaurants fell 9.2%, each the biggest fall on record.

“Production” in these industries fell 4.9% and 7.5%. Profits fell 6.8% and 14.2%.

Spending fell on ten of the 17 consumption categories.

Household consumption by category, March quarter

Commonwealth Treasury

Most of the changes took place at the very end of the March quarter.

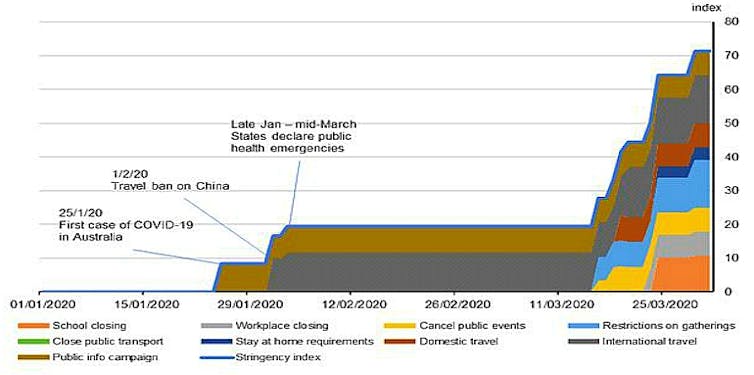

A new index of the “stringency” of COVID-19 containment measures released with the national accounts shows they ramped up only in the final two weeks.

Most have been in place for the entirety of the June quarter to date, suggesting the impacts on spending and production will be a “lot more substantial”, in the words the treasurer used in the national accounts press conference.

ABS stringency of containment measures index

Were it not for government spending, which has climbed 6.2% throughout the year, the plunge in March quarter GDP would have been much more severe.

Calculations of the Bureau of Statistics suggest it would have been twice as severe, a March quarter decline of 0.6% rather than 0.3%.

General government expenditure

Commonwealth Treasury

The treasurer described Australia as “on the edge of the cliff” in the March quarter, facing “an economist’s version of Armageddon”.

The treasury had been contemplating a fall in gross domestic product of 20% in the June quarter. Australia has avoided that fate by acting on health and the economy early.

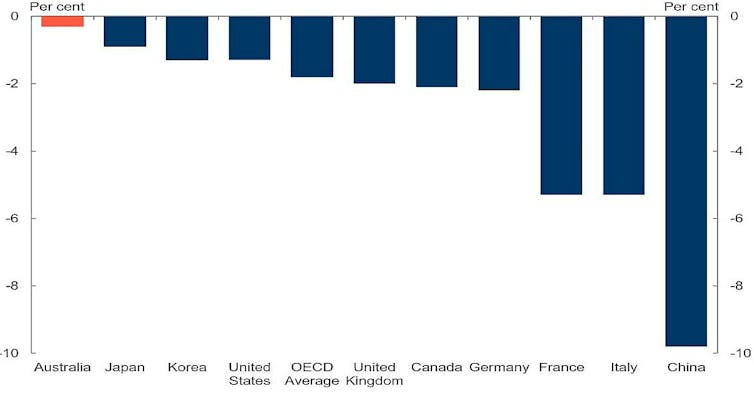

Its fall in GDP of 0.3% in the March quarter was one third the OECD average.

International comparisons, real GDP growth, March quarter

Commonwealth Treasury

The treasurer has scheduled an economic update, which will include the result of a review of the JobKeeper program.

Asked whether it could be referred to as a mini-budget, he said it could be.

Peter Martin ne travaille pas, ne conseille pas, ne possède pas de parts, ne reçoit pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'a déclaré aucune autre affiliation que son poste universitaire.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure