Pharmacy benefit manager shares dropped sharply Wednesday as lawmakers introduced bipartisan legislation requiring health insurers and PBMs to divest pharmacy operations within three years. The proposal intensifies scrutiny of the PBM industry's influence over drug pricing.

Bipartisan Bill Targets Vertical Integration in Healthcare

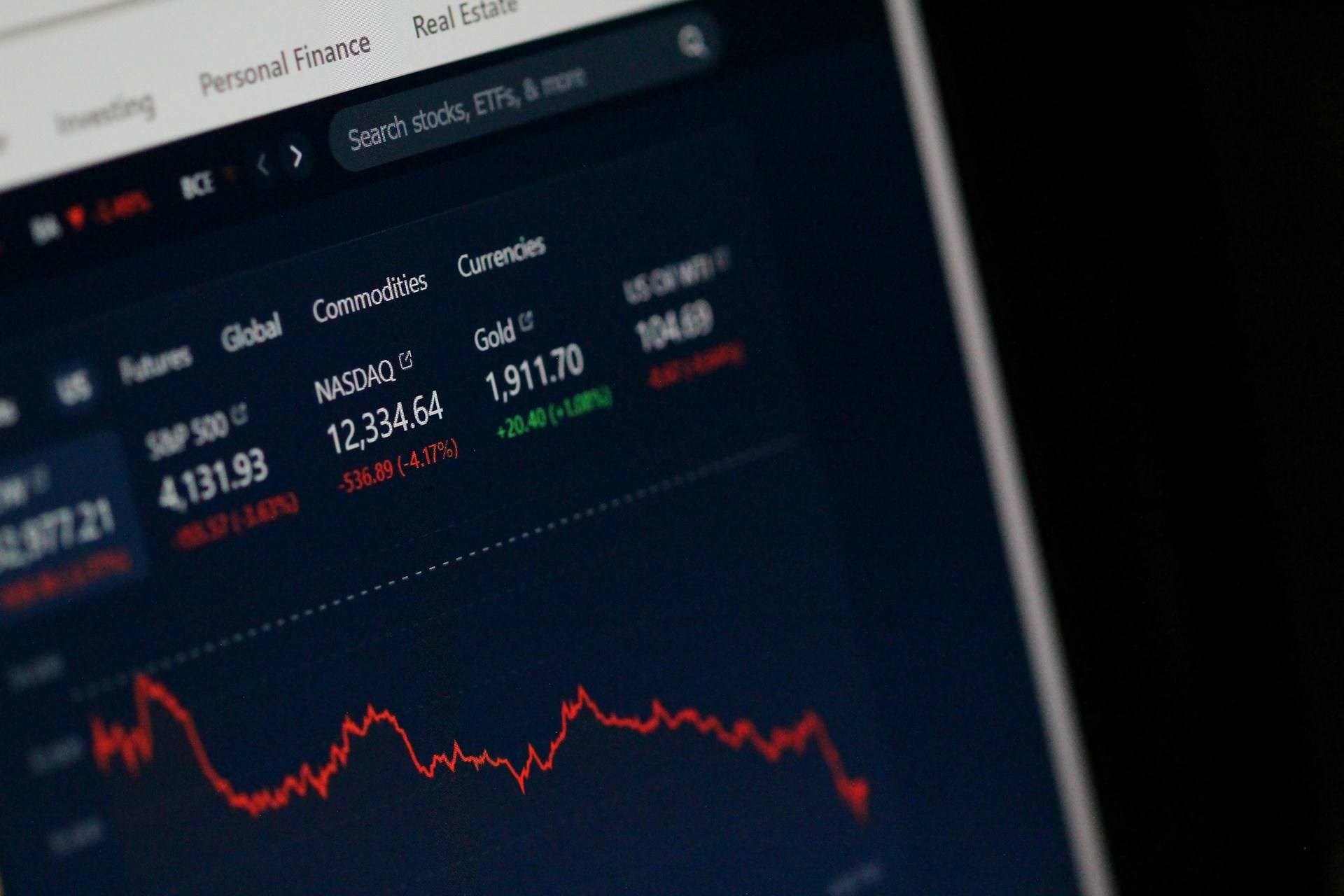

According to Reuters, following the presentation of a bipartisan measure on Wednesday, which would compel health insurers or drug intermediaries to sell off their pharmacy businesses, shares of companies owning pharmacy benefit managers declined.

The majority of pharmacy benefit management (PBM) in the US is controlled by CVS Health’s Caremark, Cigna’s Express Scripts, and UnitedHealth Group’s Optum. All three of these parent firms also own health insurance businesses.

Following the initial reporting of the bill in the Wall Street Journal, all three firms' shares fell by 4.8% to 5.5%.

The bill, which is being co-sponsored by Republican Josh Hawley and Democratic Elizabeth Warren in the United States Senate, would require, within three years, that companies that own health insurers or pharmacy benefit managers sell their shares in pharmacies.

Healthcare Stocks React to Bipartisan Proposal

This bill will be submitted in Congress with the support of Republican Diana Harshbarger and Democratic Jake Auchincloss.

Pharmacy benefit managers (PBMs) mediate pricing negotiations for prescription prescriptions between insurance companies, pharmacies, and pharmaceutical companies. PBMs then pay pharmacies directly for the medications covered by their contracts.

They have already been investigated for the impact they have on the cost of prescription drugs.

"PBMs have manipulated the market to enrich themselves — hiking up drug costs, cheating employers, and driving small pharmacies out of business. My new bipartisan bill will untangle these conflicts of interest by reining in these middlemen," Senator Warren stated.

Other Insurers Feel the Ripple Effect of PBM Legislation

Other insurance companies' stock prices dropped 1% to 3%. This included Centene, Elevance, and Humana, Investing.com shares.

"The latest introduction of potential legislation to restrict PBM operations and broader healthcare vertical integration is unlikely to gain traction, although it is hard to dismiss outright," Michael Cherny, an analyst at Leerink Partners, said.

Insurance company stock has taken a beating following last week's shooting death of UnitedHealth health insurance unit CEO Brian Thompson outside a Manhattan hotel.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal