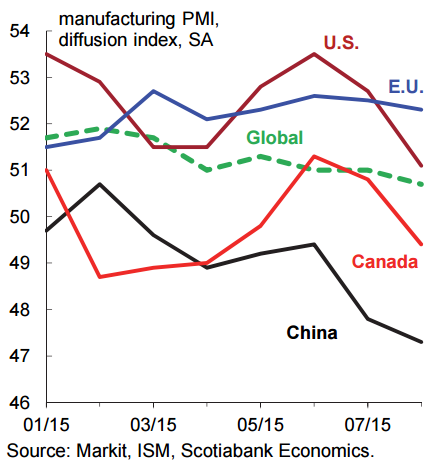

The Chinese economy is in slowdown mode, global markets and the economies linked to China's growth face further challenges. Downward bias in commodity prices, and the renewed increase in financial market turbulence are risking further weakness. Financial market volatility around the world has increased dramatically in recent weeks. Sell-off in global stock markets, followed by only a partial rebound, continues to grind lower and highlights a downgraded assessment of economic conditions and corporate earnings.

In this environment, business investment is at risk of a further slowdown in response to the increased economic uncertainty, the absence of a discernible pick-up in global demand and trade. Accordingly, prospects for global growth are likely to remain on the softer side for the time being. The biggest downside risks are in the resource-sensitive regions.

Many emerging markets and developing nations are being negatively affected by the combination of the slowdown in China, the decline in commodity prices, persistent U.S. dollar strength, the intensifying weakness in currency and financial markets. Investor confidence around the world is being challenged. There are not enough growth engines around the world. Only the U.S., the U.K. and India can be considered relative outperformers, countries which appear to be the most resilient and have the potential to generate stronger, and importantly, more sustainable activity.

Moderate growth and weak prices for many key commodities besides oil are reinforcing the likelihood of a more prolonged period of very low overall inflation. Increasingly, more and more policymakers around the world are favouring easier credit conditions and weaker domestic currencies to provide some relief. The Fed is poised to raise short-term interest rates, but the timing and extent of prospective rate hikes will depend upon the strength of the U.S. expansion and 'core' inflation, and the potential for any spillover from the volatile financial market and economic conditions around the world.

"The price of WTI crude oil recently reversed its spring-time run-up, and is currently trading nearer the lower end of a US$40-60/barrel range this year. Geopolitical events and recurring volatility aside, underlying fundamentals suggest that crude oil prices will likely remain on the weaker side for longer", says Scoitabank in a research note to its clients.

The current softness in the global economy is expected to give way the renewed economic traction as the drag from structural adjustments and financial market instability abates. Considerable pent-up demand in the U.S. should underpin steady consumer spending and housing-related gains.

Increasing monetary and fiscal stimulus should help stabilize conditions in China. Persistently low borrowing costs and low oil prices remain supportive of improved economic performances internationally. And in contrast to the Great Recession, many banks around the world are much better capitalized and capable of financing increased activity.

Global growth slowdown persists

Wednesday, September 2, 2015 10:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices