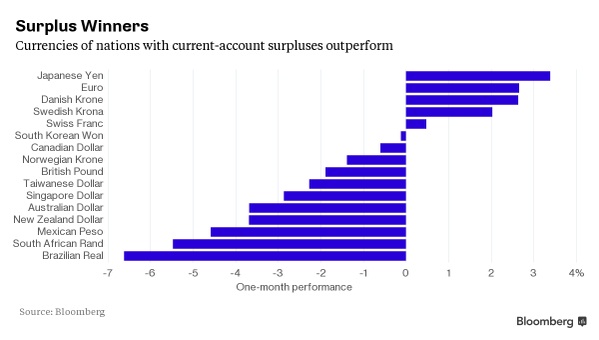

Latest analysis from Bloomberg shows that traders and investors' in latest financial market turmoil are preferring to perk their money to surplus currencies.

The chart shows, in past month alone Japanese Yen, a significant current account surplus economy, rose more than 10% against Brazilian Real, a significant deficit economy.

Taper tantrum of 2013, showed similar trend, when investors refused to finance emerging economies' large current account and fiscal account deficit, pushing currencies lower across emerging markets.

In the past one of the FxWirePro report from us showed how fundamental strategies are working best since post crisis and we expect that old book's such as buy surplus, sell deficit are likely to perform well over the next couple of quarters.

- In spite of European Central Bank's massive quantitative easing, which is pushing Euro down against all most all currencies remains a buy due to its large current account surplus and reforms to manage it fiscal deficit going ahead.

- Weaker Euro is improving the odds of better recovery across Euro zone.

In spite of China's large current account surplus, it is not likely to benefit from haven flows as the outlook going ahead is much weaker.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate