There was once again an 8-1 voting in the Bank of England's Monetary Policy Committee meeting yesterday for keeping the rates unchanged and the BoE kept the rates on hold, as the markets expected.

The minutes still indicate that 'there is a range of views among MPC members about the balance of risks to inflation' related to the projection in the Inflation Report. There was a downward revision in the inflation path as the inflation was expected to stay under 1% through H1 2016.

Lower oil price, energy bill price cuts and GBP strengthening might be the reasons behind this lower projection, which might also effect UK's CPI in long term, as estimated by BoE.

Therefore, there should be close monitoring of the GBP movements, particularly the trade weighted GBP. It looks like markets reacted to the lower inflation outlook, albeit this was mentioned in October meeting.

"GDP growth was revised down slightly for this year and next year but unchanged in 2017 and 2018. GDP growth is still expected to be at or slightly above trend over the forecast horizon and thus we expect slack to continue to diminish", says Danske bank in a research note.

The 'domestic momentum remains resilient' even though the 'outlook for global growth has weakened', as mentioned by the MPC. Uk's economic growth is domestic driven. The unemployment rate has fallen faster than previously estimated by the BoE.

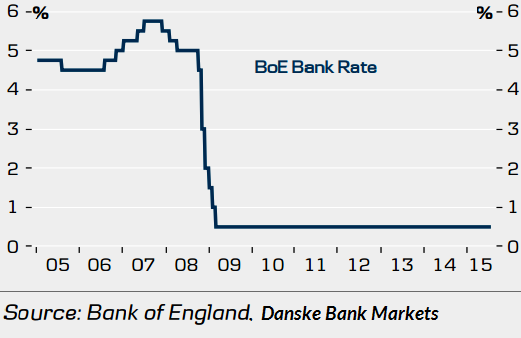

"For now, we stick to our view that the BoE will hike in Q1 16, probably in February, but these announcements imply that the probability a hike will come later, in Q2. The consensus view among analysts has also moved to a hike in Q2 over the past few months", estimates Danske Bank.

There was a 1% spike in EUR/GBP post the announcement, but according the short term anticipations this move seems faie enough, given the decline in UK interest rates and EUR/GBP's current trading levels, being very close to the estimates.

GBP still remains a concern for Bank of England

Friday, November 6, 2015 7:06 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed