1-3 Month Outlook

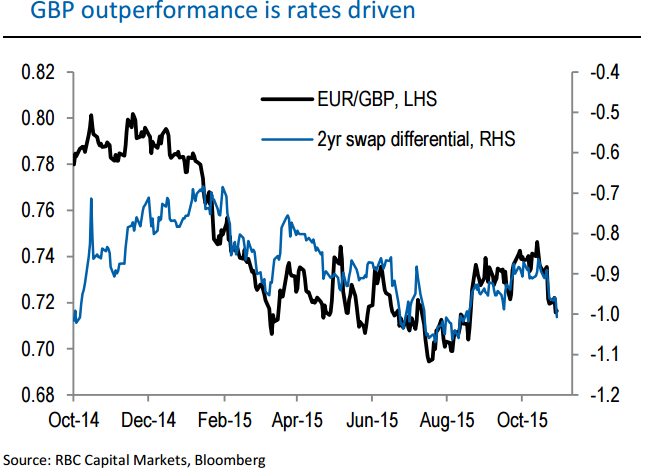

GBP's poor performance in Q3 shows tentative signs of reversal in October and November, with gains against most G10 currencies carrying the TWI 1.3% higher. Although GBP outperformance has been supported by widening rate spreads, the UK side has done relatively little, with EUR/GBP losses in particular mostly driven by lower EZ rates.

Forward rates in the UK remain very flat, with a full rate hike not priced into the SONIA curve until very late in 2016, despite repeated comments from MPC members that rates will rise sooner than that. As markets move to reprice the start of the Fed normalisation sooner than currently discounted a major side effect should be higher rate expectations in the UK, from the current low starting point. GBP outperformance on the crosses therefore remains a theme in the forecasts, with EUR/GBP expected to break back below 0.70 in the early part of 2016.

6-12 Month Outlook

Further into 2016, there are two key risks for GBP - the UK's unsustainable current account deficit and the EU referendum, promised for end-2017 at the latest. Both are manageable, however, and the current account may actually strengthen the case for GBP outperformance. The UK's external deficit is largely a public sector phenomenon and this is still true, but is becoming less so as the household sector slips into deficit. As this happens, the policy prescription is slowly shifting to tighter monetary and fiscal policy rather than fiscal policy alone.

As to the rising risk of UK EU exit, on the face of it, there are reasons to think GBP should carry a rising risk premium. The most recent YouGov poll showed a small (2pt) balance in favour of voting yes to leaving the EU after a year of clear majorities to stay in In the longer term, the balance of opinion has almost always been in favour of staying in and it still is when pollsters add a qualification that the government recommends voting to stay (which it very likely will).

"We maintain a moderately constructive long-term view on GBP, though are mindful that the risks around this view are unusually large", says RBC Capital Markets.

GBP Outlook

Thursday, November 5, 2015 10:51 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed