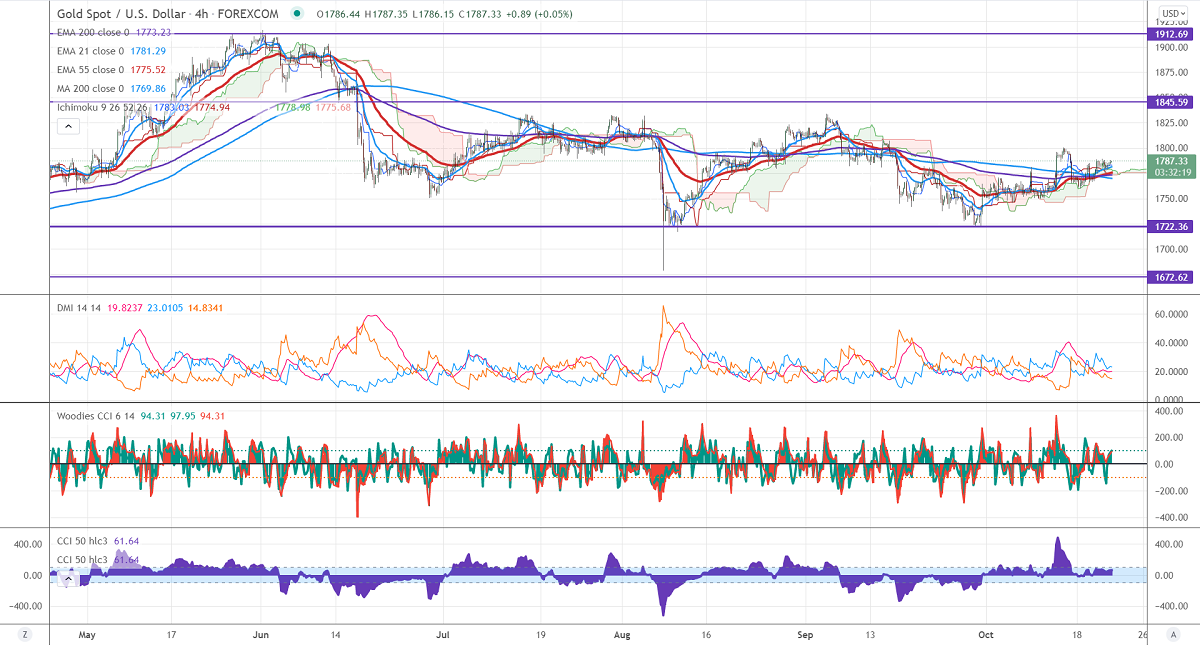

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1783.03

Kijun-Sen- $1774.94

Gold edges higher despite minor pullback in US dollar. The US dollar index regained more than 20 pips from a low of 93.49 on a strong US bond yield. Any breach below 93.50 confirms further bearishness. US stocks retreat after hitting all-time high is supporting the yellow metal. Gold hits an intraday high of $1788 and is currently trading around $1787.

Economic data;

The US Philly fed manufacturing index declined to 23.8 in Sep compared to a forecast of 25.1. The number of people who have filed for unemployment benefits dropped by 8000 to 290K the previous week vs an estimate of 298000.

. Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- bearish (positive for gold)

Technical:

It is facing strong support at $1760 violation below targets $1750/$1740/$1720. Bearish continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal $1825/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1785-86 with SL around $1800 for TP of $1720.