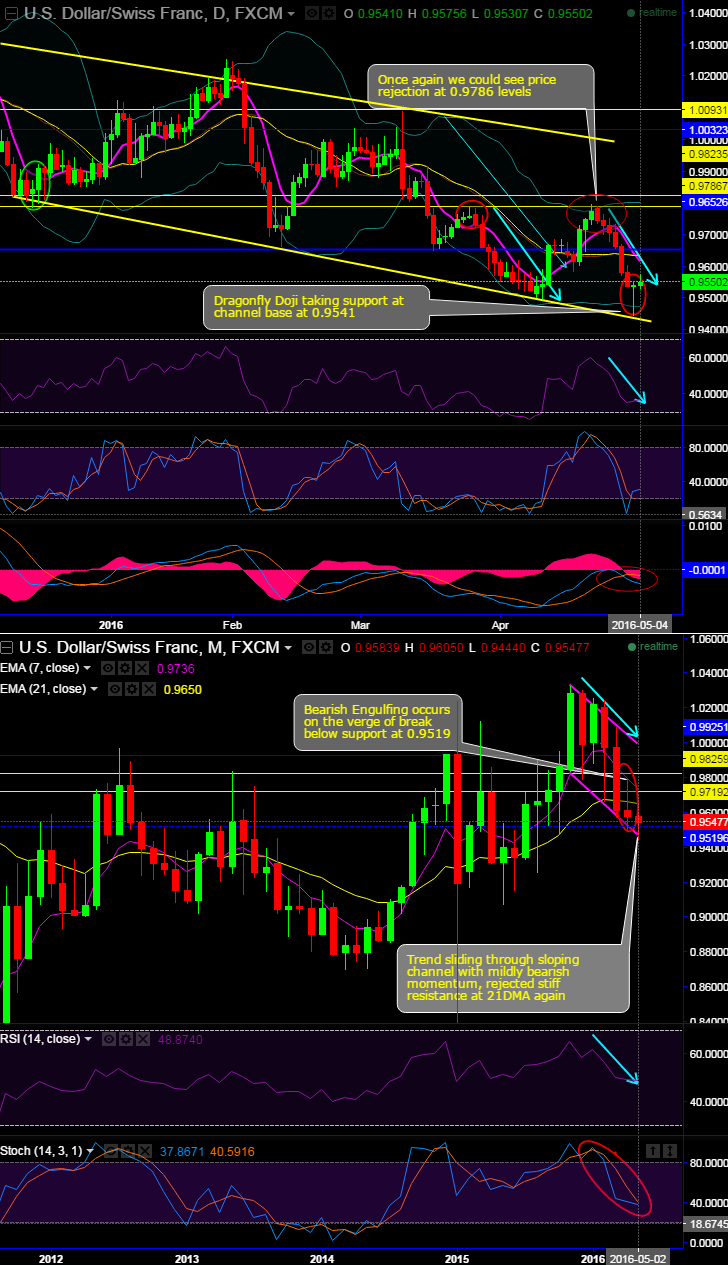

On daily charts, “Dragonfly Doji” taking support at channel base at 0.9541.

The pair has rejected stiff resistance at 0.9786 levels, as a result, after 6 days of continuous bear streaks it has now shown a little sense of recoveries (see the lower tail of dragonfly candle).

In addition to that, on weekly a “Bearish Engulfing” occurs on the verge of break below support at 0.9519.

Trend has been sliding through sloping channel with bearish momentum on both daily and weekly charts.

7DMA crosses below 21DMA again which is a sell signal.

MACD on daily remains below zero which is a bearish region has shown bearish crossover, while the lagging indicators on weekly is just entering into zero zone.

Stochastic on weekly has approached oversold territory but still boiling up with overbought pressures.

While, RSI has been converging clearly to the declining trend on both daily and weekly plotting.

Overall, major trend puzzling but intermediate trend has been bears favour, one can look ahead for rallies to short mid month futures contracts for targets at 0.9429 and below with strict stop loss at 0.9650 levels, thereby, one can have almost 1:1 risk reward ratio with this trade.