Gold’s intermediate trend has been bearish after rejecting highs of 1384.88 levels.

The gold price is down over 15.73% from the recent highs of 1384.88 levels in just Iast 5-months, and most likely to retest $1,050 after losing strong support at $1,200-$1,210 levels.

More slumps likely ahead of Fed’s rate hiking hopes in December meeting as the bears break the major support at 1208 & 1200 marks after bearish crossover on SMAs on weekly terms.

Fed hikes before 2017 is also very much on cards. The underlying spot gold price is sensitive to moves in U.S. rates, as a rise would lift the opportunity cost of holding non-yielding assets such as bullion. The recent data flow is mixed, but Fed hike by year-end remains likely.

Some softer news on core inflation and jobless claims.

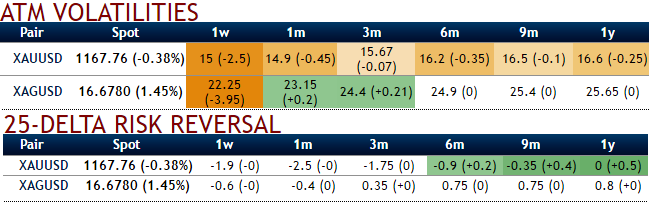

As you can observe 1w IV are reducing considerably which is a good news for short-term option writers. While delta risk reversals across various tenors are mounting bearish hedging sentiments in the long run.

Considering all these parameters we gold prices are likely to plummet further towards 1100 and 1050 levels as this precious metal price is always US rate sensitive.

Hence, we reckon gamma puts are the most conducive instruments in reverse put spreads as a downside hedging vehicle as this tool is indicative of the rate of change of the Delta values with respect to the movement of the rate in the underlying market. In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

Thus, bidding 1w IVs and 1m risk reversals, we recommend initiating longs in 2 lots of 1m at the money gamma put options, while writing 1w (1%) in the money put options, the strategy is to be constructed at net debit.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays