Hawkish commentary from Bank of Canada officials this month has taken the FX market by storm. The implied probability of a 25bp BoC rate hike in its 12 July meeting has exploded from under 5% just three weeks ago to over 70% currently, and a full hike is priced in for 3Q17, according to Bloomberg.

BoC Governor Poloz's latest comments earlier this week were pointedly hawkish, stating that the 2015 rate cuts (of 50bp) “have done their job”, and that the BoC should be reconsidering the policy rate level, as “excess capacity is being used up steadily.” Deputy Governor Patterson also mentioned this week that “the economic drag from lower crude oil prices is largely behind us.”

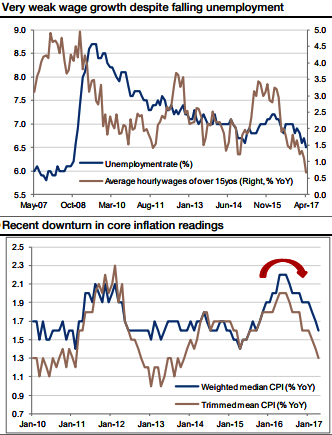

We previously mentioned the positive growth momentum in Canada this year but noted that inflation remained the crucial missing piece. Wage growth has been unexpectedly weak despite the low unemployment rate, and core inflation readings have trended lower for several months (refer above charts).

Nonetheless, the signal from the BoC is very clear, and a rate hike is imminent, if not at the July meeting, then in September. A full economic update will be released with the BoC’s monetary policy report after the 12 July meeting.

Hence, factoring all the above fundamental aspects, Lonnie’s undervaluation should support further appreciation.

USDCAD is attempting to test key support at 1.30/1.2970, and a break will open the way to the May 2016 lows of 1.25. Recent highs of 1.3350 will cap short-term upside. We’ve pointed USDCAD to slide towards 1.25 as the target once support at 1.30 is broken decisively and sustain below this level, as is likely in coming weeks.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings