EURCHF is so far tracking our forecast which assumes a softening in the SNB’s intervention regime and a resultant orderly decline of around one cent per quarter in the cross to 1.03 by year-end.

What has Switzerland to do with US FX policy one may ask? The answer is that Switzerland is the third largest holder of FX reserves globally (6% of global reserves for an economy which accounts for 0.9% of global GDP).

It is also one of only two countries that currently exceed the threshold for FX intervention the US Treasury has established as prima facie evidence of currency manipulation (persistent, one-sided intervention exceeding 2% of GDP).

Switzerland is also the sixth largest owner of US Treasuries (rising to fourth if offshore centers are excluded).

In short, Switzerland has a long and enduring history of FX intervention. This may be regarded as a legitimate expression of domestic monetary policy by some observers, but could equally be construed as currency manipulation by others.

The simple point is that the international climate has become less permissive towards large-scale intervention and this is a secondary reason to expect the SNB to progressively taper the amount it intervenes.

The primary reason is that there is no compelling economic rationale for the SNB to frustrate all of the CHF appreciation that would be justified by Switzerland’s juggernaut current account surplus. We stay short EURCHF in cash and add downside in USDCHF through a 3-month put spread.

Our choice of a put spread is motivated by:

1) The French election calendar should prevent USD/Europe from running away ahead of the second-round presidential runoff on May 7 and the Assembly elections on June 11 and 18, and

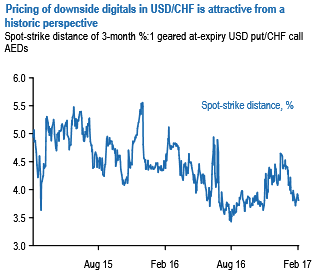

2) Digitals are reasonably priced for downside in USDCHF (refer above chart).

The digital profile can be replicated with a vanilla spread.

Buy a 3m 1.0313-0.95 USDCHF put spread (spot reference 1.0030).

Stay short EURCHF in spot FX, indicative offer at +0.12%.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays