Well, as per our prediction inn our recent write up, sideway swings on daily term have headed towards bearish business.

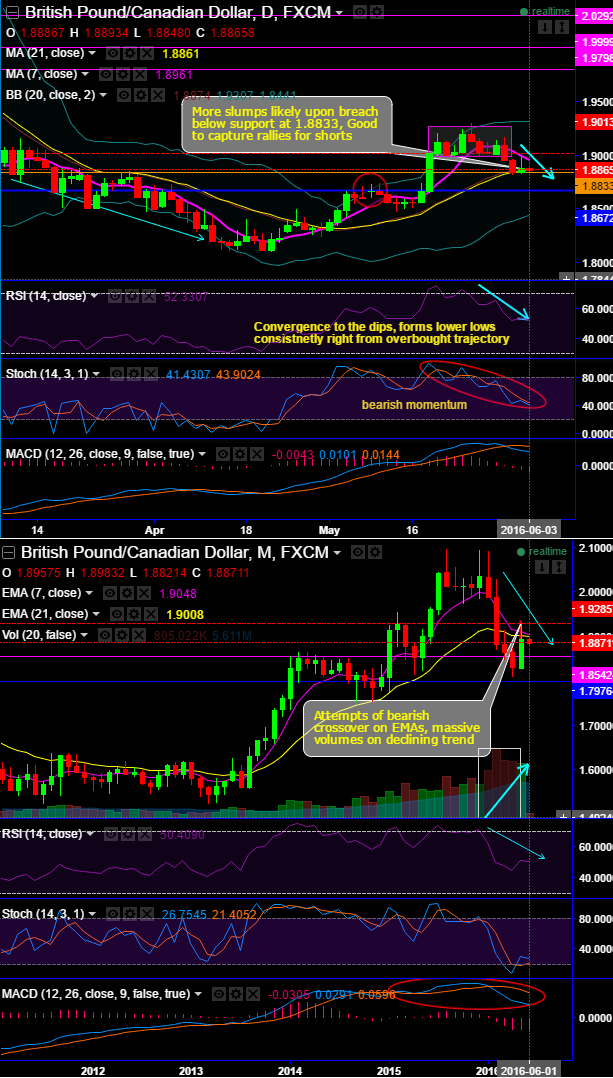

After pair evidencing whipsaws on resistance at 1.8866 levels and the price slid below 7DMA whipsaws pattern has given an expected outcome considering previous rallies.

Sideway trend lasted from last 3 weeks has now slipped below DMAs as the bears to resume again after sliding below 7DMA.

Although bears are active for today, currently, testing support at 1.8833 levels.

More slumps likely upon breach below support at 1.8833, Good to capture rallies for shorts.

Despite the attempts of upswings in last month the current prices have remained well below EMAs.

It seems intermediary bulls have been exhausted currently as the attempts of bearish crossover on EMAs is spotted, massive volumes are in conformity to the declining trend.

Both leading and lagging indicators still signal selling momentum.

Hence, the intraday trend has been stiff but one can get benefitted from the boundary binary options as the leading indicators suggest contraction in ongoing selling momentum. Thus, it is good to buy boundary binary options choosing strikes within the range of 100 pips at spot reference 1.8872 for minimum targets of 50-60 pips on either sides, use 1H expiries to fetch desired results.

Alternatively, one can also go long in 2w (1%) ITM -0.49 delta put option simultaneously shorting 1w (1.5%) OTM puts with positive theta or closer zero, OTM option writing with shorter expiries would derive certain yields that can reduce cost in buying expensive ITM puts.