The wide dislocations as observed in the market might also imply an elevated reward for embracing long-risk trades. Possibly, keeping in mind the liquidity issue in vol space as mentioned above, one takeaway from the filtering analysis would be to wait until market conditions stabilize before looking at fading any residual risk premia by then.

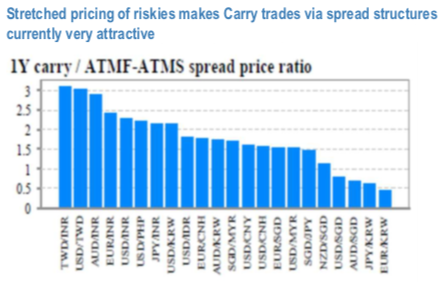

Otherwise, long risk trades should better be expressed via structures whose downside risk is well defined at inception. One such case could be via EM Carry trades via put spreads. While our EM strategy team remains extremely conservative towards EM, as COVID-19 starts to take its toll on global growth, the generally mild pricing of Asian riskies, excluding KRW, makes long Carry trades expressed via spreads historically attractive (refer above chart). This is particularly the case in the Asian space, where risk-reward for such trades is positively skewed, especially for cases like USDINR, EURINR and EURCNH.

USDCNY hitting 7.10 level has been hyped for a few times over the past weeks. Yesterday, we again saw that the magic of 7.10 mark - USDCNY touched as high as 7.13 in the morning session but closed as low as 7.08. If we extend the time horizon, this specific level seems to be gradually forming since 19 March. In the meantime, we could also see that the USD-CNY has closed below 7.10 during most of the trading days, which means that the CNY mostly closed stronger than 7.10 versus the USD. I think many would agree that there should a magic hand behind this magic number - PBoC seems to set a tone for the market for the time being.

Consider: 3M ATMF/ATMS put spread on USDINR at USD 1.5% (off spot reference: 75.3, fwd 77.88).

1y ATMF/ATMS put spread on EURCNH at EUR 1.4% (off spot reference: 7.8365, fwd 7.97). Courtesy: JPM

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025