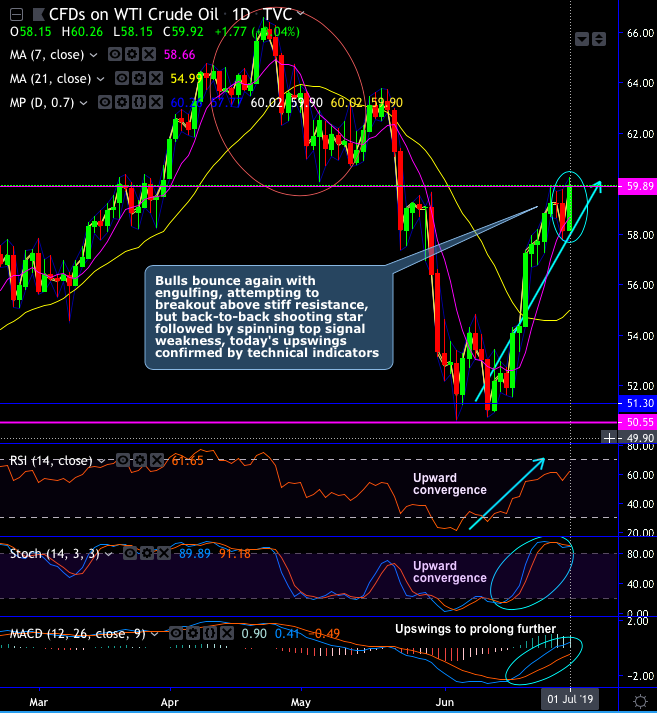

WTI crude prices bounced back above $59.50 levels (or +2.89%). Bulls bounce again with engulfing pattern at 59.83 levels and attempting to break out above stiff resistance of 59.89 areas (refer daily chart). But back-to-back shooting star followed by spinning top at that juncture, still signals weakness, today's upswings confirmed by technical indicators.

On the flip side, sharp rallies were upon hammer formation but on the contrary, steep slumps below EMAs cannot be ruled out upon bearish engulfing pattern at 53.34 level. The current price remains below 100-EMAs and the downtrend continuation also on cards as both momentum oscillators signal overbought pressures.

Fundamentally, OPEC and its allied partners are meeting-up for two days with a view of seeking common consensus on a production deal. It’s hard, though, not to feel as if the real epicenter of global oil power lies thousands of miles away—in Washington or Moscow.

Hence, contemplating above developments, crude oil derivatives trades are advocated on hedging grounds: We activated WTI crude directional hedge, by rolling over shorts CME WTI futures for July delivery for arresting downside risks in short-run, simultaneously, longs in CME WTI futures of August’2019 month deliveries.

In addition, we initiated a risk reversal strategy by going long in Brent Dec’19 10D call versus short Dec’19 10D put. They also went tactically short Brent-Dubai Q3’19 swap spread due to mounting risks from Iran sanctions. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 17 levels (which is mildly bullish), while hourly USD spot index was at 76 (highly bullish) while articulating (at 13:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis